Selling digital goods and services worldwide means staying on top of sales tax, VAT, or other tax regulations imposed on digital goods all over the world. Depending on the business model you're using, MoR![]() The merchant of record is the entity that holds legal title to goods or services and from which the customer purchases these goods or services. (Merchant of Record

The merchant of record is the entity that holds legal title to goods or services and from which the customer purchases these goods or services. (Merchant of Record![]() The merchant of record is the entity that holds legal title to goods or services and from which the customer purchases these goods or services.), cSP (Cleverbridge Service Provider), or a combination of both, different rules apply:

The merchant of record is the entity that holds legal title to goods or services and from which the customer purchases these goods or services.), cSP (Cleverbridge Service Provider), or a combination of both, different rules apply:

- If you're working with us using the MoR model, Cleverbridge takes care of global taxation, that is tax registration, calculation, filing, remittance, and exemptions, and keeps you globally compliant with existing and upcoming tax regulations worldwide.

- If you're under the cSP model, you take care of all aspects related to taxation in the markets where you sell your digital products and services. For our cSP model, we partnered with Avalara, an end-to-end tax compliance solution, to help you collect, file, and remit sales tax for your US customers.

How Tax Exemptions are Handled

Independently of the business model you chose, Cleverbridge offers a seamless tax exemption solution for your US customers. This functionality can be implemented via:

Note

If you're under the cSP model and unless stipulated otherwise in your contract agreement with Cleverbridge, you're expected to handle tax exemptions.

Self-Service Application for Tax Exemption

Scenario

The customer![]() An individual or business purchasing your product or service by placing an order through Cleverbridge. The customer is the end user of this product, as they are not allowed to resell the purchased products or services.

A customer is unique per client. If a customer purchases products or services from two different clients, there are 2 separate records of said customer. submits a new tax exemption document for the initial purchase

An individual or business purchasing your product or service by placing an order through Cleverbridge. The customer is the end user of this product, as they are not allowed to resell the purchased products or services.

A customer is unique per client. If a customer purchases products or services from two different clients, there are 2 separate records of said customer. submits a new tax exemption document for the initial purchase![]() An order made by a customer and the records associated with it. by filling an online form during the checkout. The following happens:

An order made by a customer and the records associated with it. by filling an online form during the checkout. The following happens:

-

A payment

Exchange of money for goods and services in an acceptable amount to the customer where the payment amount has been agreed upon in advance. The customer can only pay with an accepted payment method. Each payment has an individual payment cost. processing specialist reviews the uploaded tax exemption document and validates the tax exemption request.

The validated document is saved as Valid in the Cleverbridge platform.

Exchange of money for goods and services in an acceptable amount to the customer where the payment amount has been agreed upon in advance. The customer can only pay with an accepted payment method. Each payment has an individual payment cost. processing specialist reviews the uploaded tax exemption document and validates the tax exemption request.

The validated document is saved as Valid in the Cleverbridge platform.

- A payment processing specialist sends an email with valid tax exemption document ID to the customer.

- The customer completes the purchase and is exempted from paying the sales tax for the transaction.

Note

Once a tax exemption document is saved as Valid under the MoR model, the Cleverbridge platform remembers valid IDs to facilitate the tax exemption for future purchases. Customers only have to introduce the valid tax exemption ID during the checkout process to be automatically exempted for future transactions.

Manual Tax Exemptions Management

Scenario

The customer submits a request for tax exemption via email before completing the purchase in the checkout. A Cleverbridge payment processing specialist uploads the tax exemption document manually in our web admin tool. The following happens:

- A payment processing specialist reviews the uploaded tax exemption document and validates the tax exemption request. The validated document is saved as Valid in the Cleverbridge platform.

- If the tax exemption document could not be validated, the customer is asked to provide a valid document via email.

- Two possibilities unfold:

- The customer is exempted from paying a sales tax for purchasing the product if they submitted a valid request before completing the transaction.

- The customer receives a refund for the collected sales tax on the purchase if they submitted a valid request after completing the transaction.

Note

Payment processing specialists can assign tax exemption requests in the Cleverbridge platform. They can also create and modify uploaded tax exemption documents. For more information on the Tax Exemption feature available in our web admin tool, see Manage > Tax Exemptions.

Avalara AvaTax Configuration Guide

If you're under the cSP model, Avalara enables you to quickly start calculating, collecting, and remitting sales tax in your checkout flow for your US customers. To achieve that aim, do the following:

Important

You can access the AvaTax account in our web admin tool once you complete the onboarding process successfully.

Connect to Avalara AvaTax

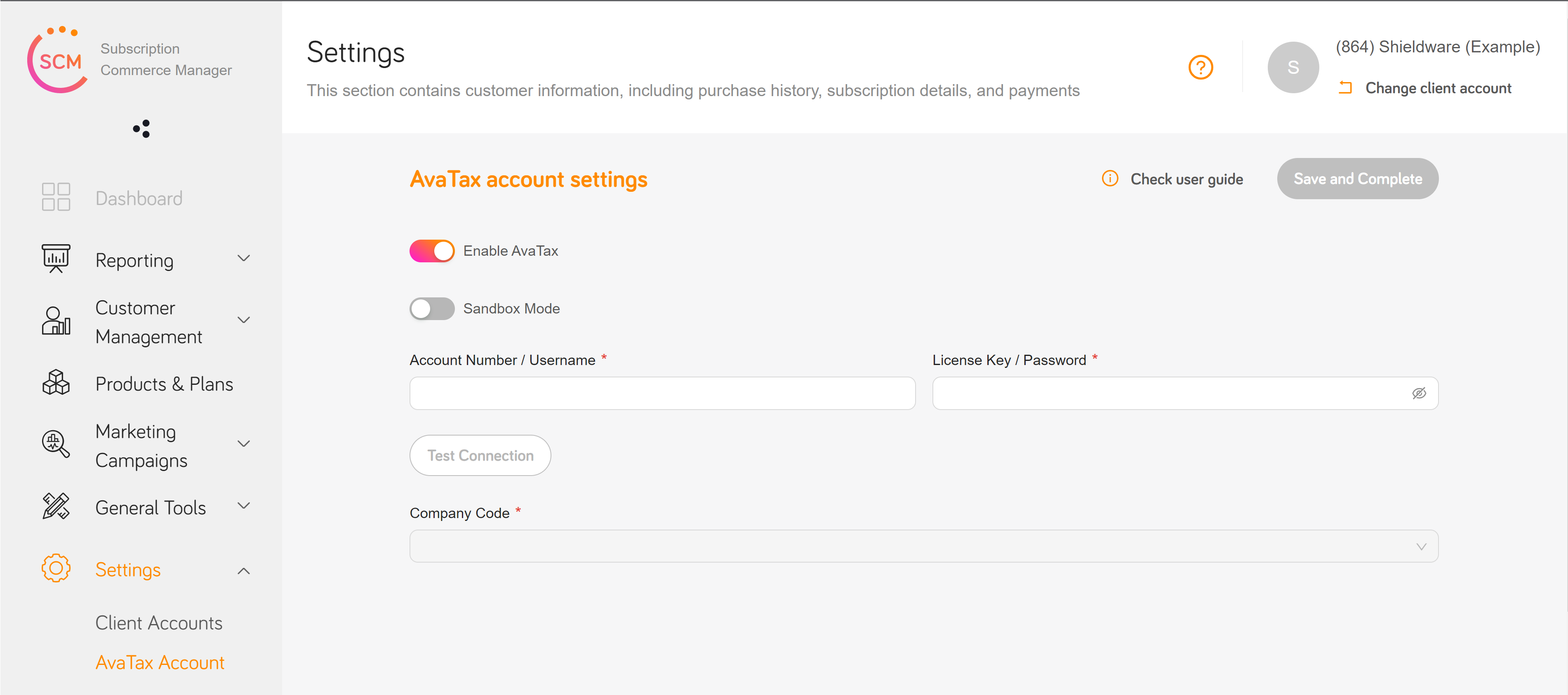

To connect to Avalara AvaTax, open the Subscription Commerce Manager and do the following:

- Go to Settings and click AvaTax account.

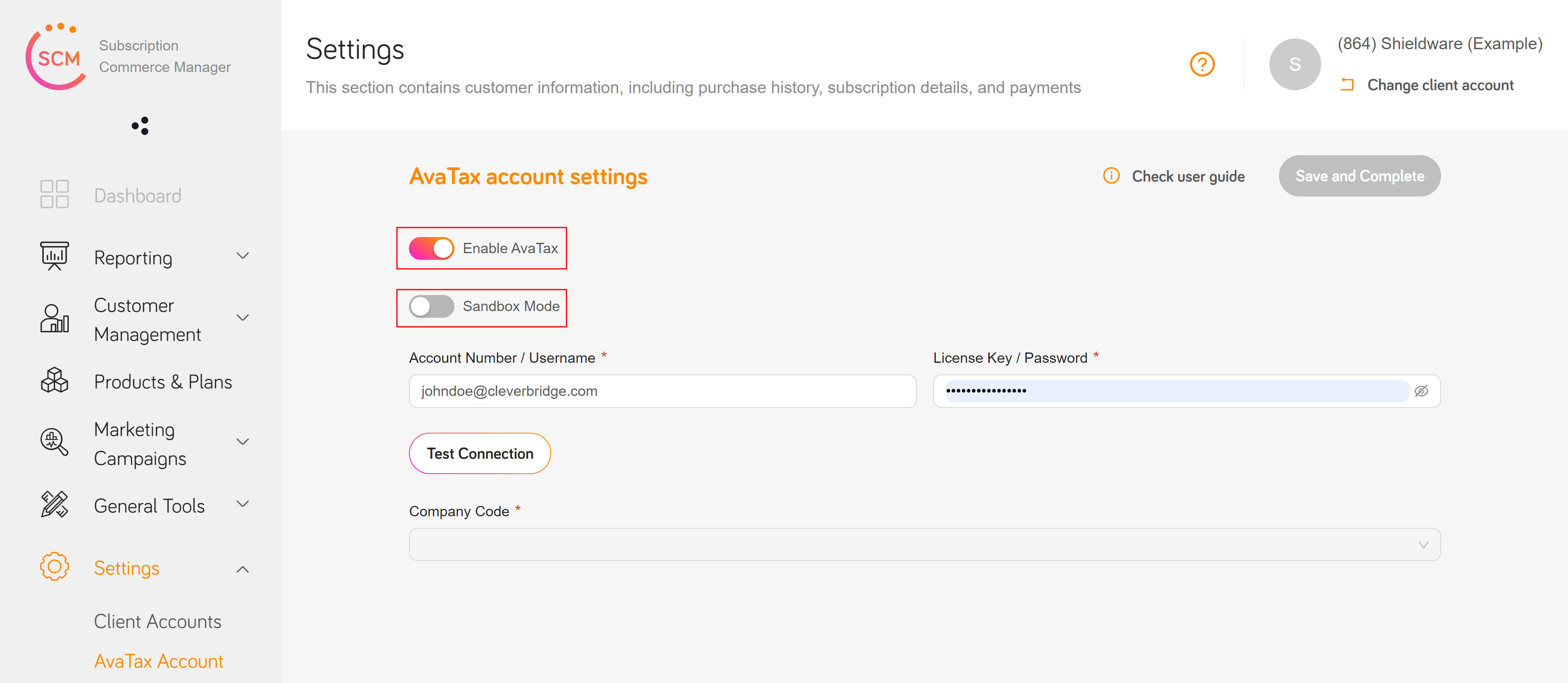

- Enter your Account Number/Username and Software License Key/Password. Your Avalara AvaTax credentials were provided during your AvaTax account activation process.

- Click Test Connection and enter your Company Code once the test connection is successful.

- Click Save and complete.

Note

If you change your Account Number/Username or Software License Key/Password, you must validate the connection again by clicking Test Connection and selecting your newly generated Company Code, additionally available in your Avalara AvaTax account.

Configure Avalara AvaTax

Configure Avalara AvaTax further by doing the following:

- To disable tax calculation, uncheck the Enable AvaTax box.

- To test safely within your AvaTax account, check the Sandbox Mode box.