Invoicing requirements

Issuing comprehensive and compliant invoices is an important consideration when targeting the global market. Cleverbridge oversees invoicing requirements and guarantees worldwide invoice compliance by generating invoices that fully adhere to local tax laws.

Standard requirements

The following requirements apply to all payment-related documents, including receipts, order confirmations, tax invoices, proforma invoices, quotes, and more.

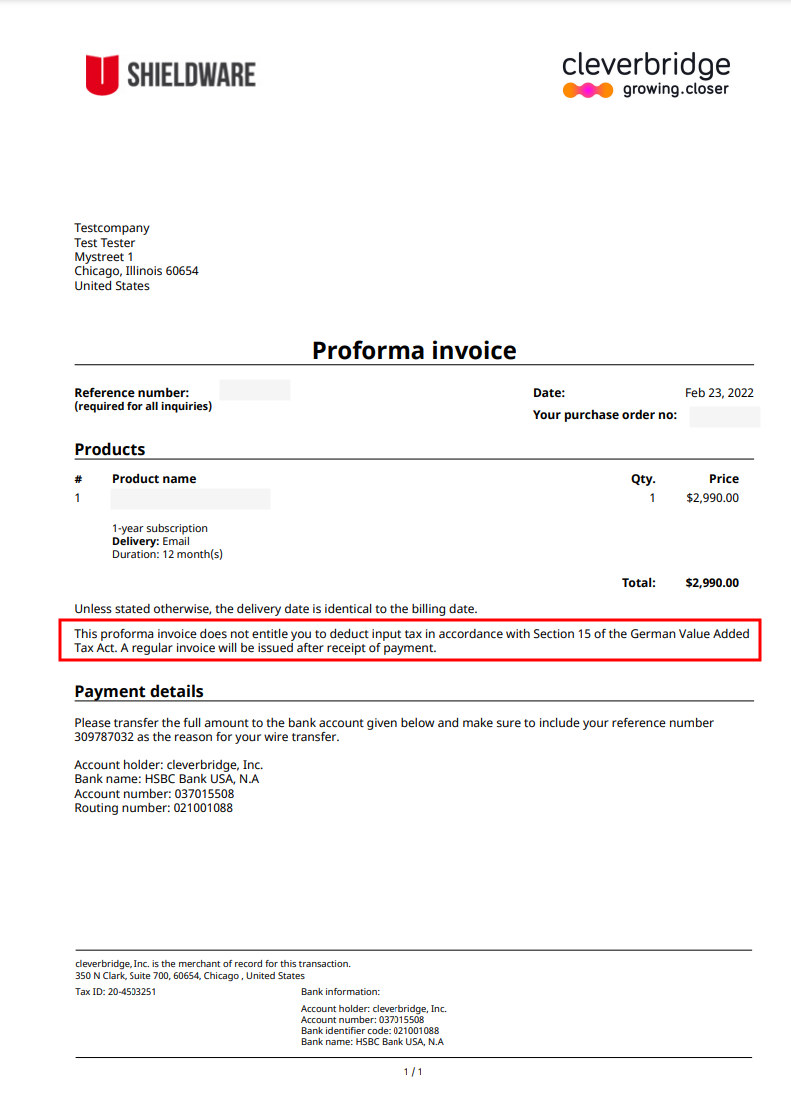

B2B customers who opt for Prepayment as a payment option automatically receive the recently issued proforma invoice within their order confirmation email. This facilitates timely payment before product delivery, and contributes to a seamless customer experience. For additional details, contact Client Experience.

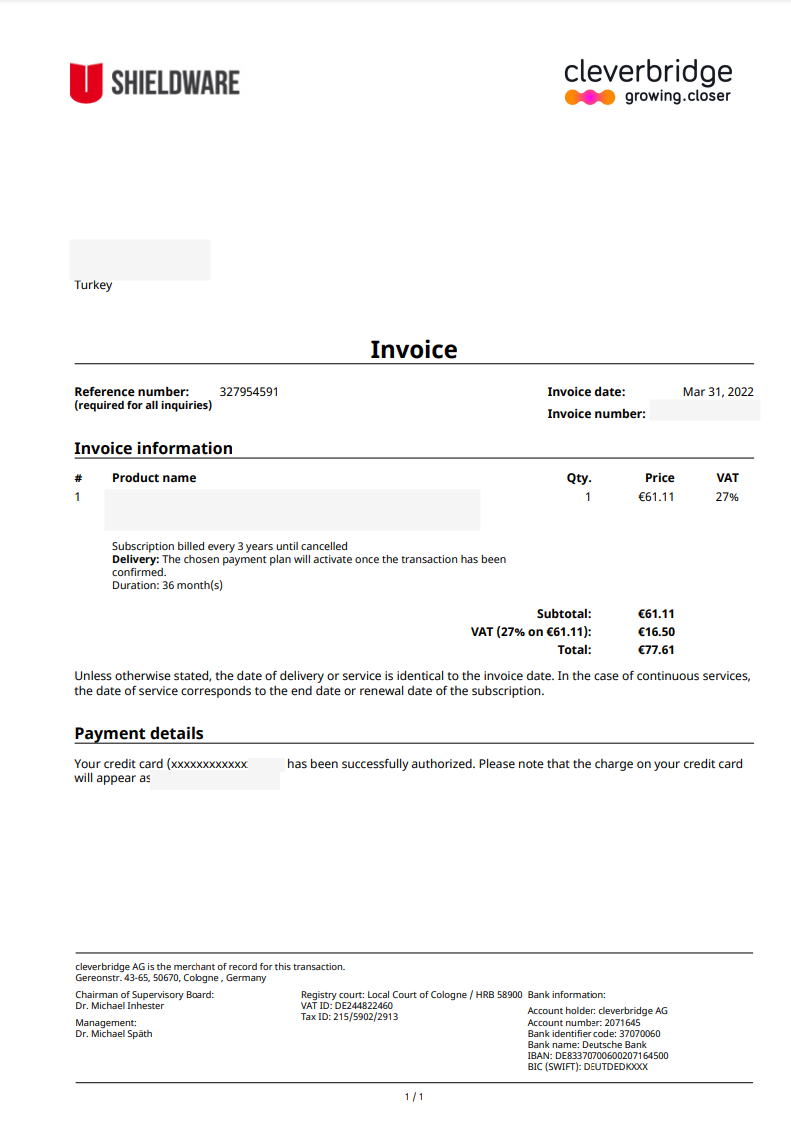

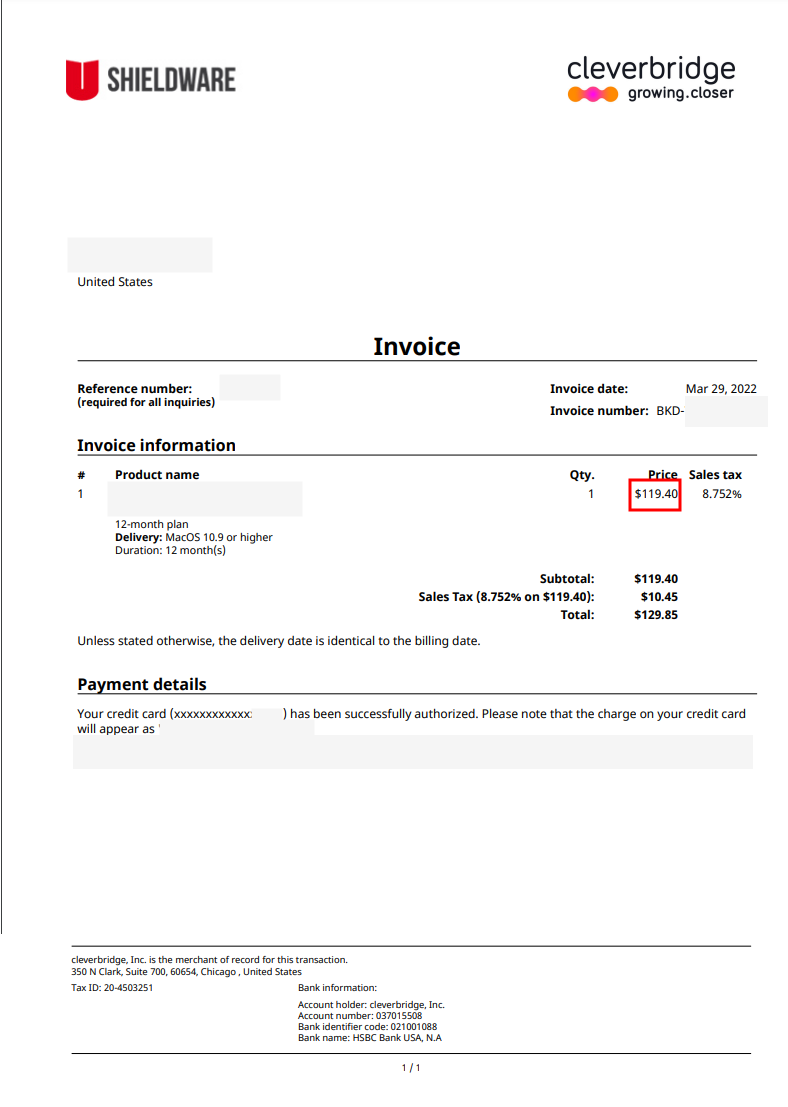

The recently introduced invoice incorporates the essential components and information outlined below:

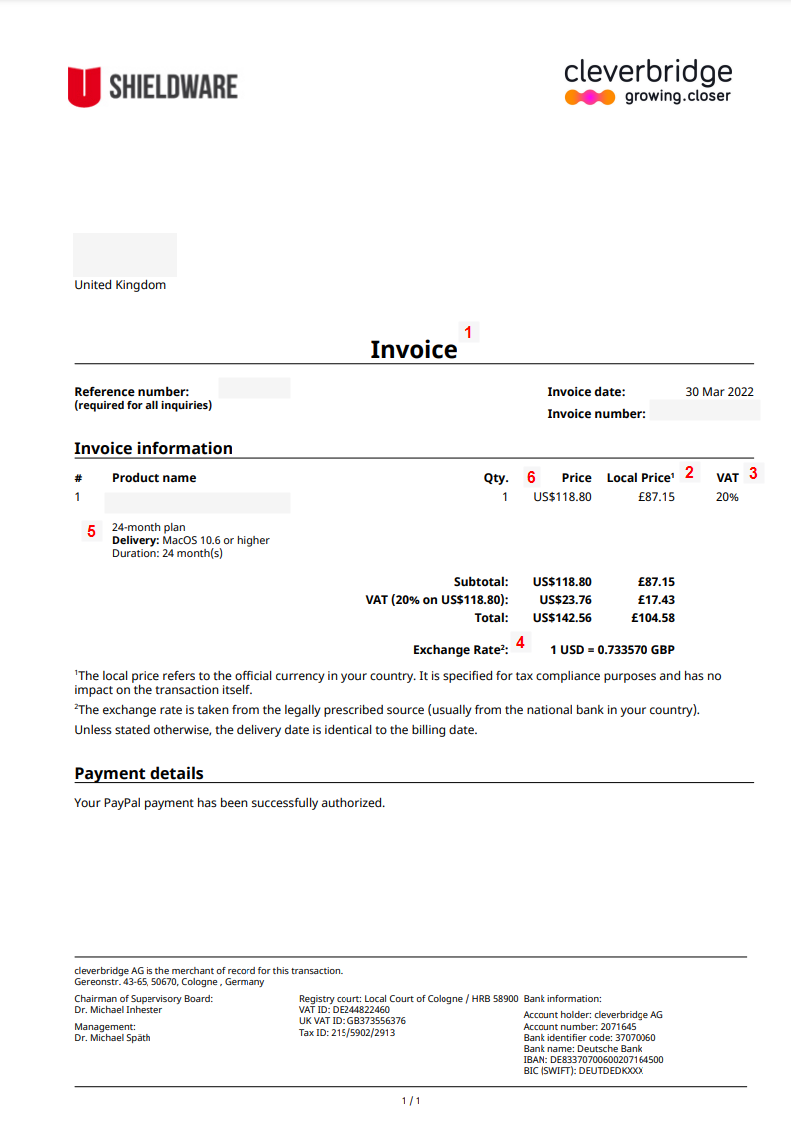

Dynamic invoice language (1)

It adjusts based on the country of registration. To meet both local tax authority requirements and customer expectations, Cleverbridge ensures flexibility and maintains default and fallback languages for registered countries. For registered country details, see Tax Rates for Digital Products.

If a German-speaking customer in Turkey places an order, the invoice will be generated in English. This is because, in addition to Turkish, English serves as the accepted fallback language in Turkey, which is understood by the majority of customers.

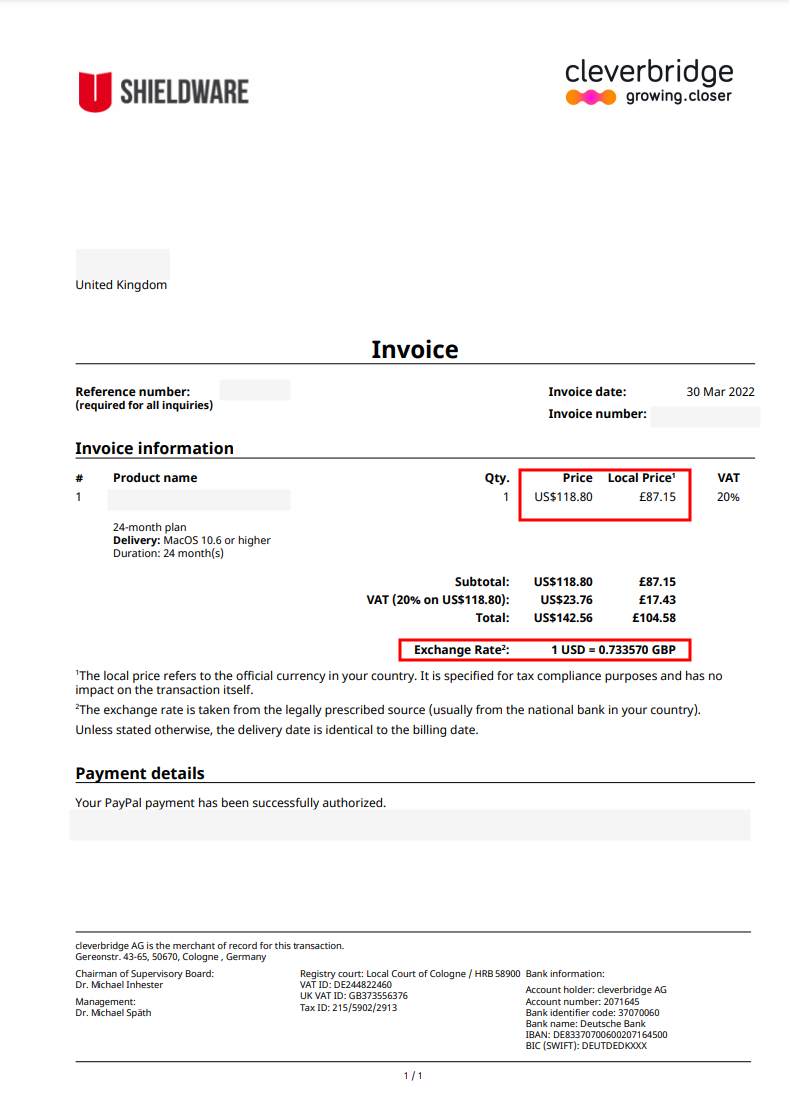

Local price (2)

Regardless of the customer's selected checkout currency, the invoice must display the invoiced amount in the local currency. This is particularly relevant for purchases made in a different currency when customers relocate.

If an American customer is in the United Kingdom and buys a product in US Dollars instead of British Pounds, the receipt displays the payment price in US Dollars, the local price in British Pounds, and the current exchange rate.

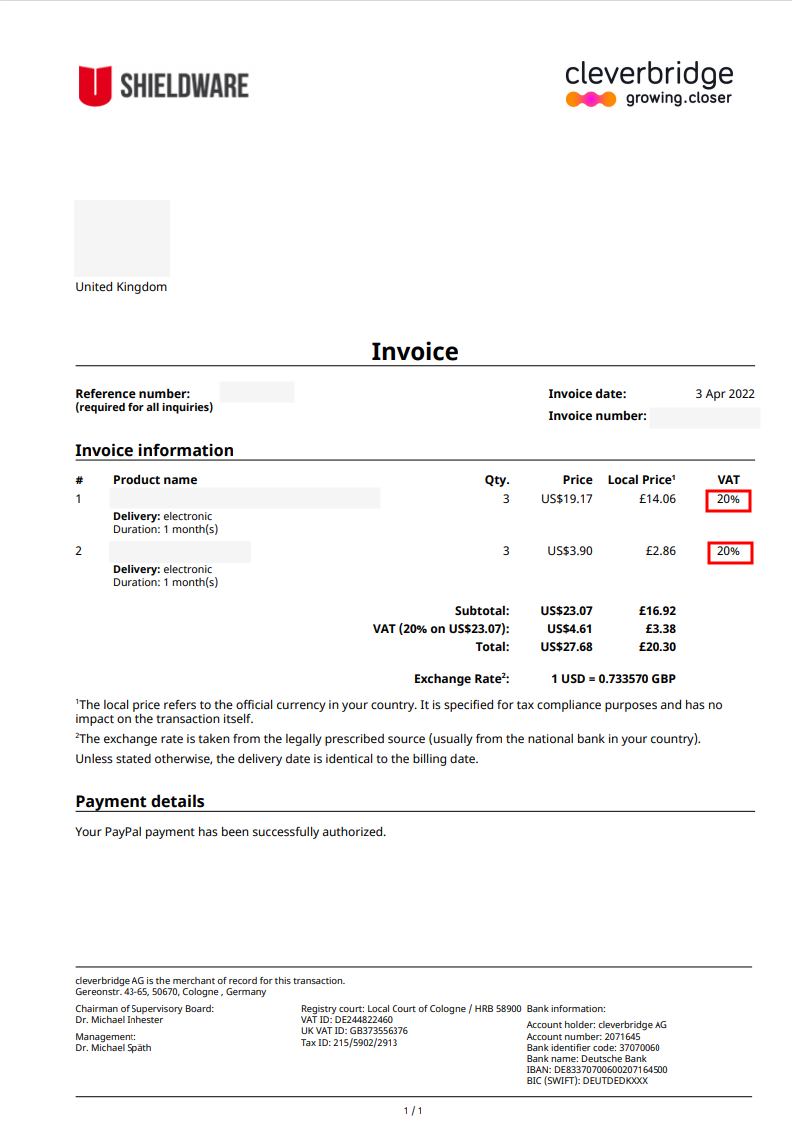

VAT/tax rate (3)

The VAT or tax rate applied to the purchase should be displayed at the product level and not only appear as a value under the subtotal amount on the invoice.

Similarly to the example involving the local price, when an American customer in the United Kingdom purchases a product in US Dollars instead of British Pounds, the receipt displays the applicable VAT rate in the United Kingdom on the product level.

Foreign exchange rate (4)

The invoice must specify the current conversion rate used for the transaction, which is linked to the registration country. See the example involving the local price for details.

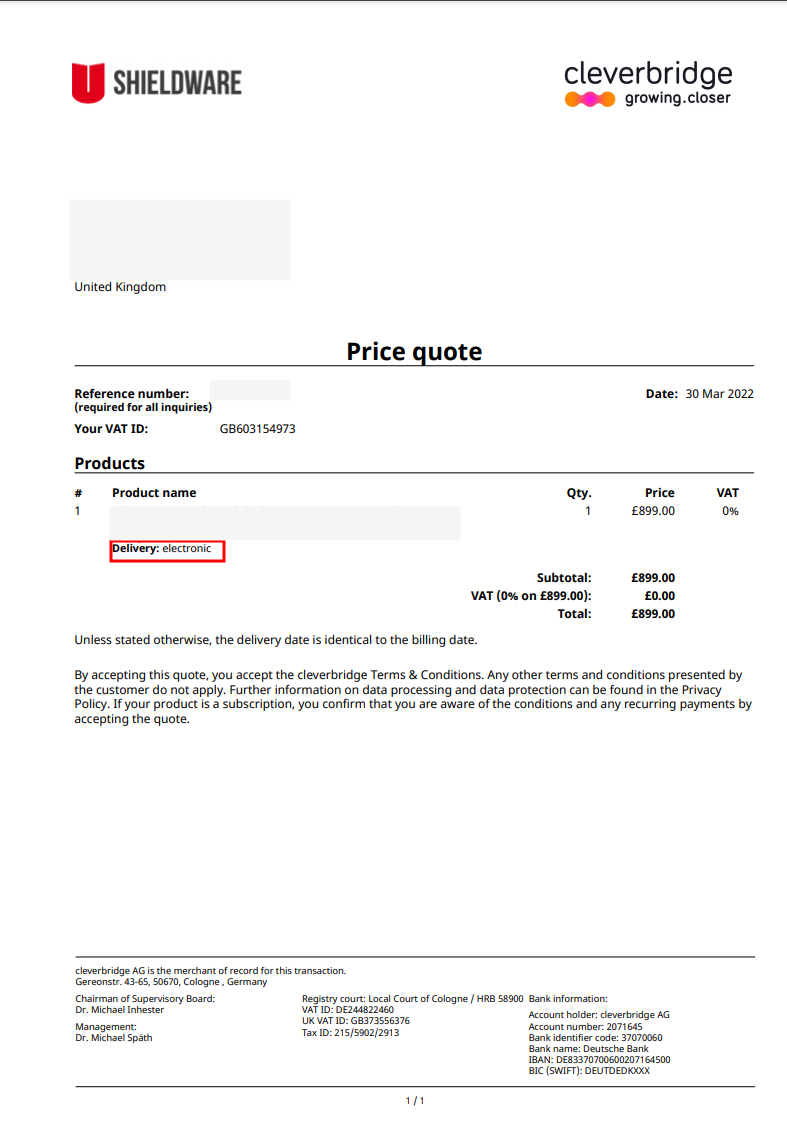

Delivery type (5)

Whether electronic or physical, the delivery type appears now under the purchased product instead of on its right-hand side.

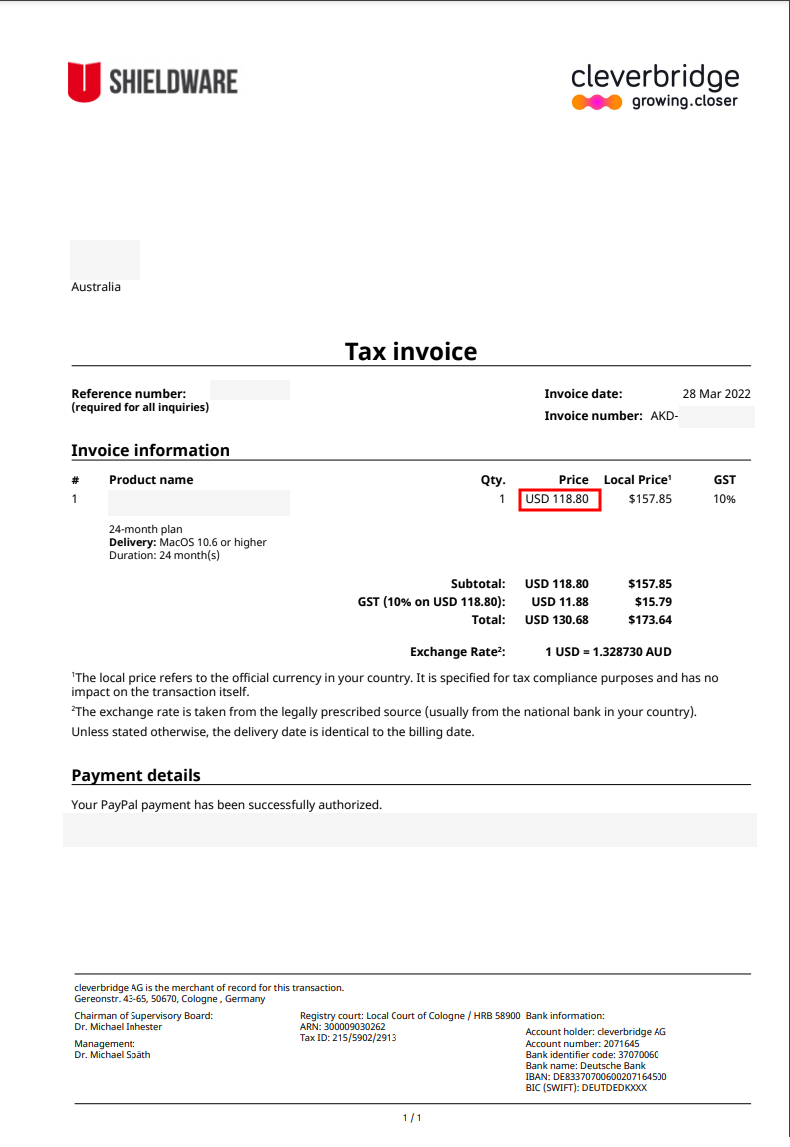

Dynamic currency symbol (6)

By leveraging the Common Locale Data Repository (CLDR), currency, date, and address information will be automatically localized.

If a Australian customer buys a product in US Dollars, the currency symbol on the receipt appears as USD. However, if a US customer purchases a product in US Dollars, the currency symbol on the receipt displays as $.

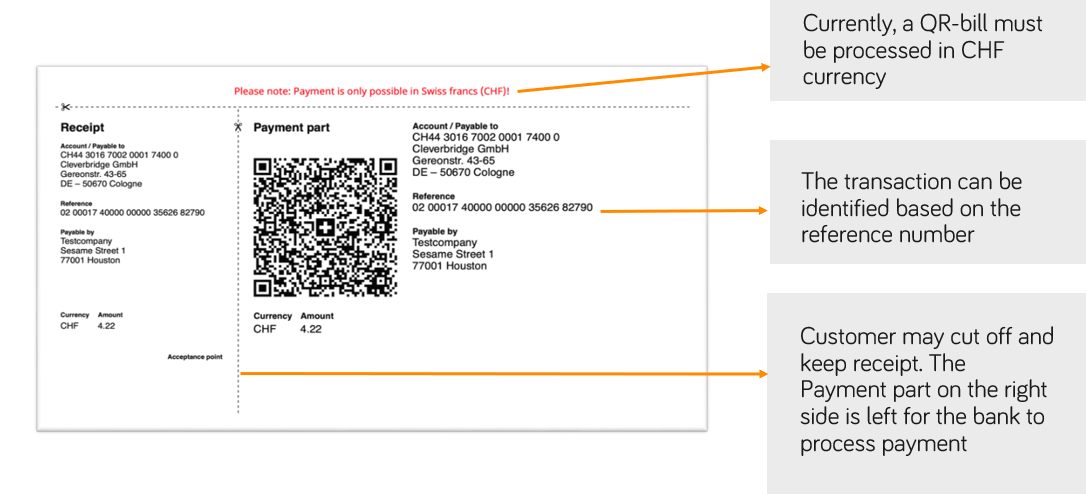

Specific requirements for Swiss customers

In Switzerland, as of October 1, 2022, customers receive QR-bills instead of traditional payment slips (IS and IRS) to execute payments. For Switzerland-based customers, Cleverbridge now supports the strict information requirements in order confirmations, proforma invoices, and invoice documents.

To meet layout requirements, the QR-bill is placed on a separate page from the receipt. The implementation of QR-bills eliminates the need for customers to manually input payment information, thereby reducing manual work and the associated risk of errors.