How exemptions work

Regardless of the business model you've chosen, Cleverbridge provides a seamless tax exemption solution for your US customers. This functionality can be implemented through:

Self-service application for tax exemption

If you fall under the cSP model and unless otherwise specified in your contract agreement with Cleverbridge, you are responsible for managing tax exemptions.

When a customer initiates a new tax exemption for their initial purchase, they complete an online form during the checkout process. The following happens:

-

A payment processing specialist meticulously examines the submitted tax exemption document, verifying the accuracy of the request. Upon validation, the document is recorded as Valid within the Cleverbridge platform.

-

Subsequently, a payment processing specialist sends an email to the customer, providing them with the valid tax exemption document ID.

-

The customer finalizes the purchase, enjoying exemption from the payment of sales tax for the transaction.

After a tax exemption document is marked as Valid in the MoR model, Cleverbridge platform stores the valid IDs for future transactions. Customers need only input the valid tax exemption ID during checkout to automatically enjoy exemption from sales tax in subsequent purchases.

Manual tax exemptions management

When a customer seeks tax exemption, they submit a request via email before finalizing the purchase in the checkout process. A Cleverbridge payment processing specialist manually uploads the tax exemption document using SCM. The following occurs:

-

A payment processing specialist meticulously reviews the uploaded tax exemption document, validating the request. If successful, the document is marked as Valid within the Cleverbridge platform.

-

If the document cannot be validated, the customer is prompted to submit a valid document via email.

-

In the event of successful validation:

- The customer is exempted from paying sales tax for the product if the valid request was submitted before completing the transaction.

- If the valid request is submitted after completing the transaction, the customer receives a refund for the collected sales tax on the purchase.

Payment processing specialists in the Cleverbridge platform can assign and manage tax exemption requests, including the creation and modification of uploaded tax exemption documents. For further details on the Tax Exemption dashboard, see Manage Tax Exemptions.

Configuring Avalara AvaTax

For our cSP model, we partnered with Avalara, an end-to-end tax compliance solution,to assist you in collecting, filing, and remitting sales tax for your U.S. customers. To accomplish this goal, follow these steps:

Once you successfully complete the onboarding process, you can access to the AvaTax account through SCM.

To connect with Avalara AvaTax, follow these steps in SCM:

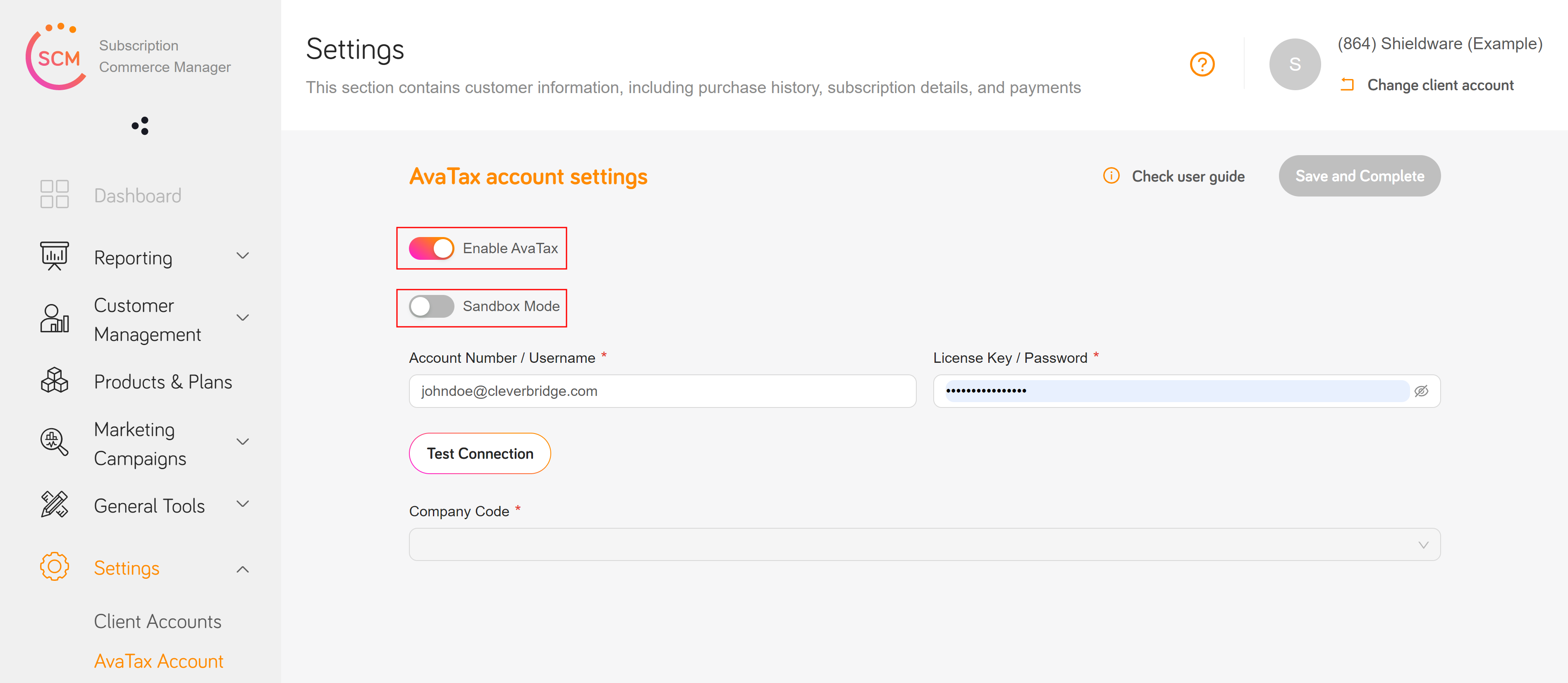

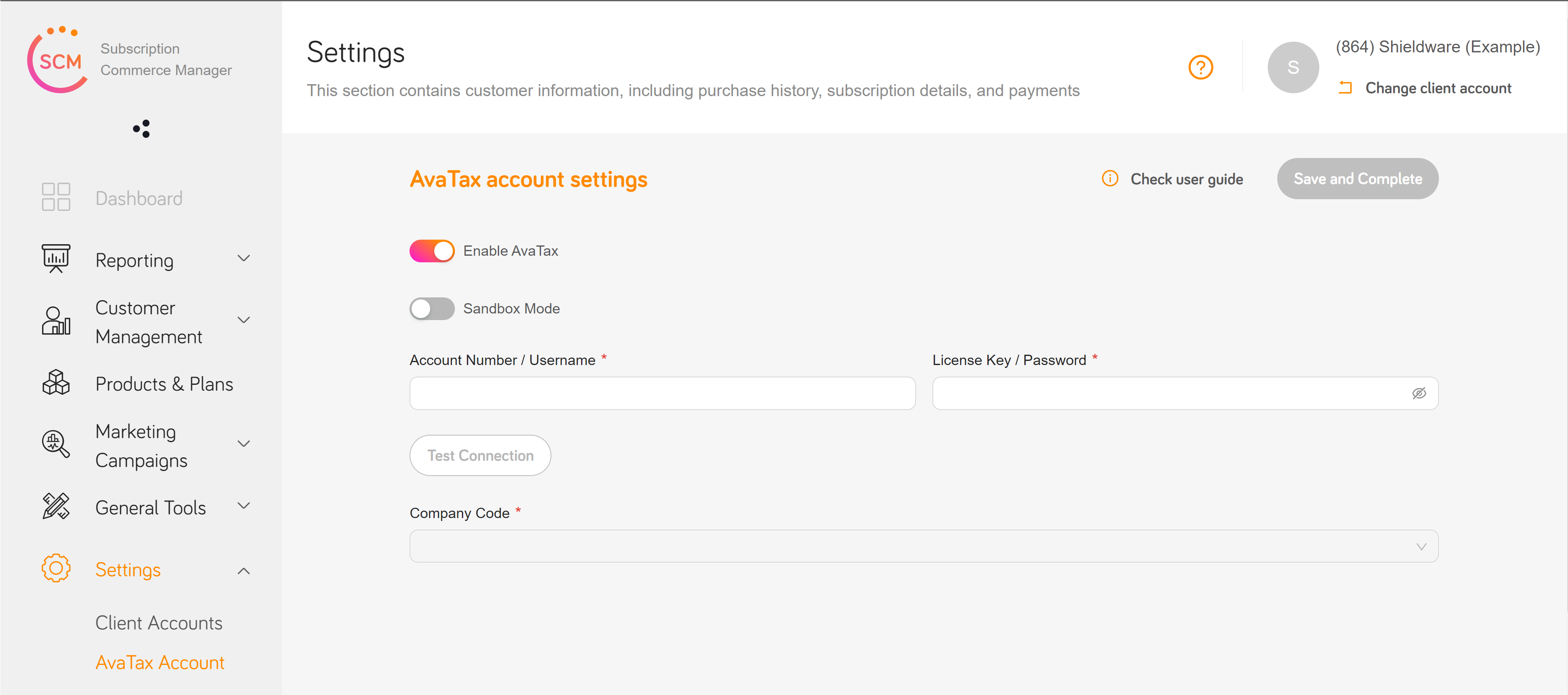

- Navigate to Settings and select AvaTax Account.

- Input your Account Number/Username and Software License Key/Password. These credentials were provided during your AvaTax account activation.

- Verify the connection by clicking Test Connection, and upon success, enter your Company Code.

- Click Save and complete to complete the process.

To configure Avalara AvaTax further, do the following:

- To deactivate tax calculation, uncheck the Enable AvaTax box.

- For secure testing within your AvaTax account, select the Sandbox Mode box.