Performance data vs. clearing reports

While the data retrieved from Snowflake includes performance-related metrics suitable for a wide range of analytics, it is not a replacement for the official Clearing Report and should not be used for financial reconciliation purposes.

Cleverbridge Secure Data Share gives you powerful access to performance data, but it is not designed for financial reconciliation. You get flexible, row-level performance data based on your integration setup, allowing you to track key metrics and trends in real time. However, this flexibility also makes it possible to draw incorrect conclusions.

At the same time, Clearing Reports are an official, consolidated source of financial truth. They apply finalized exchange rates at the end of each financial period and are used to calculate payouts. These reports are generated with strict reconciliation logic and should be your reference point for any financial reporting or settlement purposes.

The following table present some of the key differences between the two:

| Performance Data (Snowflake) | Clearing Reports | |

|---|---|---|

| Data Source | Row-level, integration-based view | Reconciled financial report |

| Flexibility | High (custom queries, dynamic analysis) | Low (fixed format, standardized) |

| Purpose | Operational monitoring and management decisions | Financial reconciliation and payout processing |

| Audience | Ecommerce Managers | Financial Controllers |

| Reporting Period | Depends on query definition | Fixed for the client |

| Exchange Rate Application | Applied based on configuration | Applied at end of financial period |

| Payment Attribution | Upon payment authorization | Upon payment settlement |

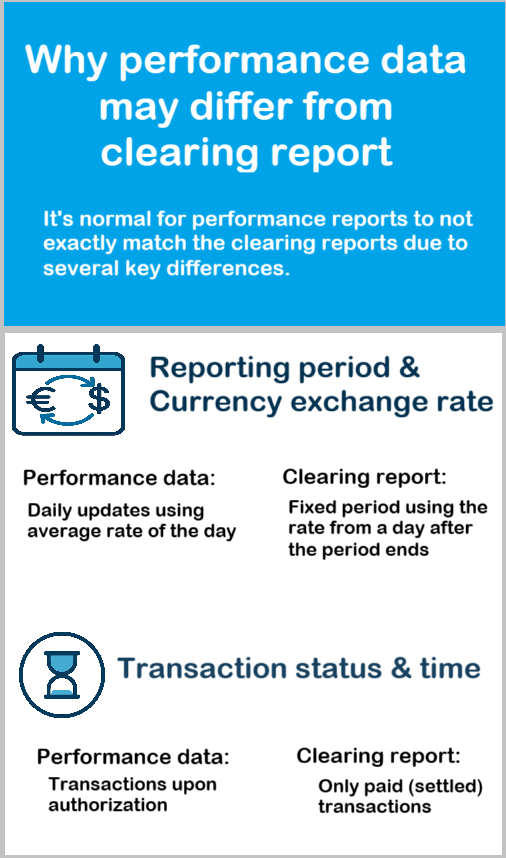

Why the performance data may differ from the clearing values

It's completely normal for the data in your performance reports based on Snowflake row data not match exactly with the figures in your clearing report. This is due to several important differences mentioned above:

How the reporting period & currency exchange affect the result

When a client sells in multiple markets, they typically define a product currency (also referred to as "client currency) in which a product’s price is set and charged to the customer. Separately, they define one or more payout currencies, which are the currencies in which Cleverbridge transfers funds to them.

- If the performance data is collected daily, it uses the average exchange rate of that specific day to convert values into your chosen reporting or client currency.

- However, the clearing report summarizes performance for a fixed reporting period and applies the exchange rate from the day after the period ends.

Since exchange rates fluctuate slightly every day, it's expected that you’ll see small differences in totals between the performance and clearing views. These variations can go both positively and negatively, but they are typically minor and reflect natural currency shifts.

If a purchase was made on March 15 in USD and your report currency is EUR, the performance report for that day will use the average exchange rate on March 15. But the clearing report for that week will apply the rate from the next day of the end of the reporting period (for monthly reporting in our example this would be April 1st). The difference in conversion may cause a slight variance.

How Transaction Statuses affect the result

Another reason for differences is when payments are attributed.

- Performance data usually reflects transactions as soon as they're authorized.

- In the clearing report, only finalized (paid) transactions are included. This means that some payments may shift into a different reporting period depending on when they’re settled.

A transaction is authorized on June 30 but is only successfully paid on July 2. The performance report for June will include it, but the clearing report will assign it to July. As a result, June’s performance data may appear higher—but this difference is balanced out by July’s clearing totals.

Such attribution time variations are natural for the following payment methods:

- Alipay

- Direct Debit

- iDEAL

- Credit Cards.

The reported values balance out across adjacent reporting periods.

Data differences summarized

Performance data offers speed and flexibility, and clearing reports deliver accuracy and finality, and differences between the two are expected due to the purpose of each data set.

Understanding how timing, currency handling, and transaction status influence the data ensures you can interpret both reports correctly and use them together with confidence.