Net Banking (India)

Net Banking is a local online-banking payment method supported via a local PSP. It enables customers to pay directly from their Indian bank account either as a one-time payment or by creating an eNACH mandate for subscriptions.

To add Net Banking to your checkout, contact our Client Experience.

Net Banking can be used for both one-time payments and subscription payments (via an eNACH mandate). The flow and timing differ depending on which option the customer selects:

- One-time payments are typically confirmed within seconds, and the purchase status updates to Paid.

- Subscriptions (eNACH) create a mandate immediately, but the payment confirmation can take time to settle. During this time, the purchase remains Awaiting Offline Payment, even though the mandate was accepted.

- One-Time Payments

- Subscriptions

At a high level, the customer just logs in to their bank and approves the payment. However, let's go through the process step by step.

Screenshots are for illustration purposes only. The actual experience may vary depending on your checkout settings and the customer’s bank.

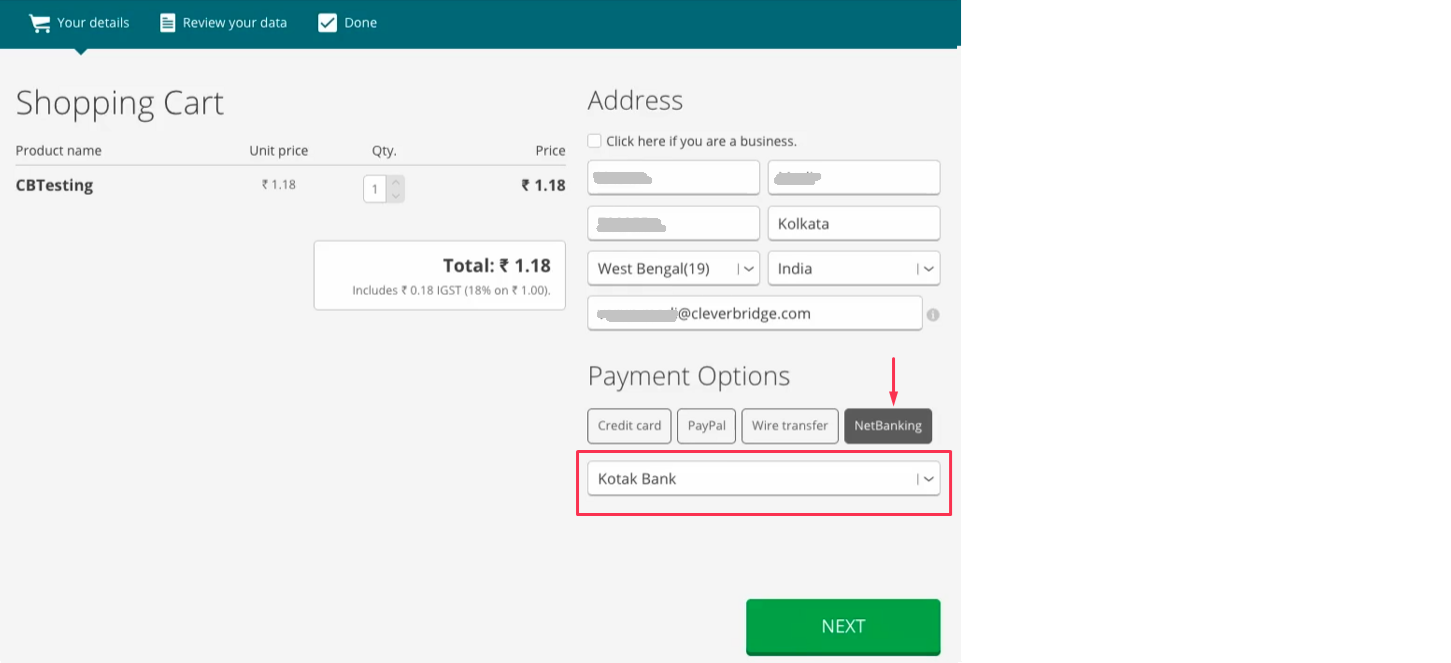

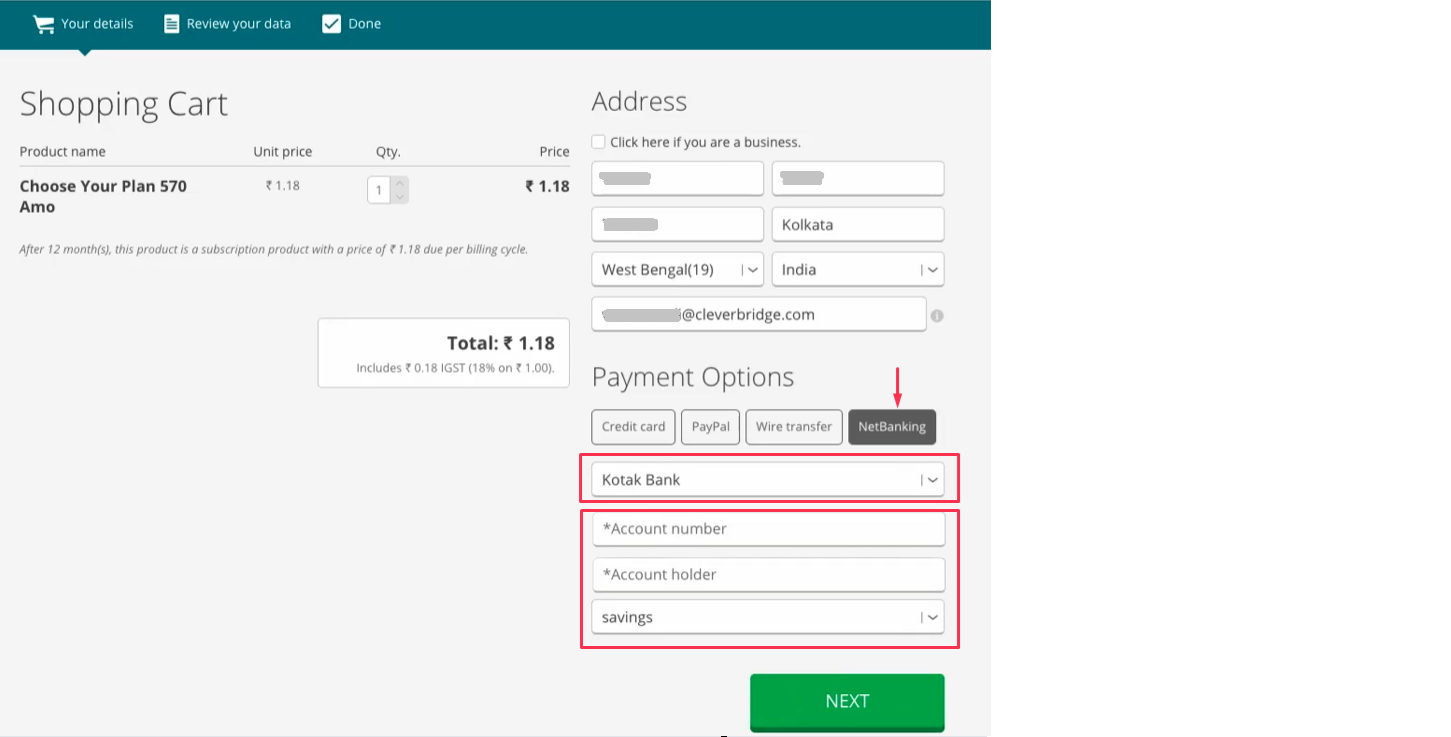

- On the Cleverbridge checkout, the customer selects NetBanking payment option, and defines the bank to make the payment through.

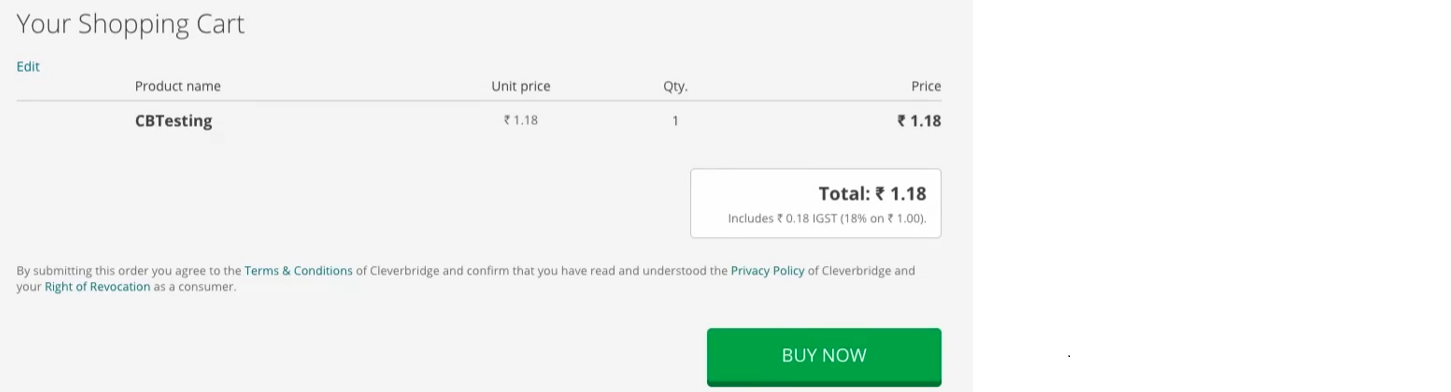

- The customer reviews the order and confirms the purchase details.

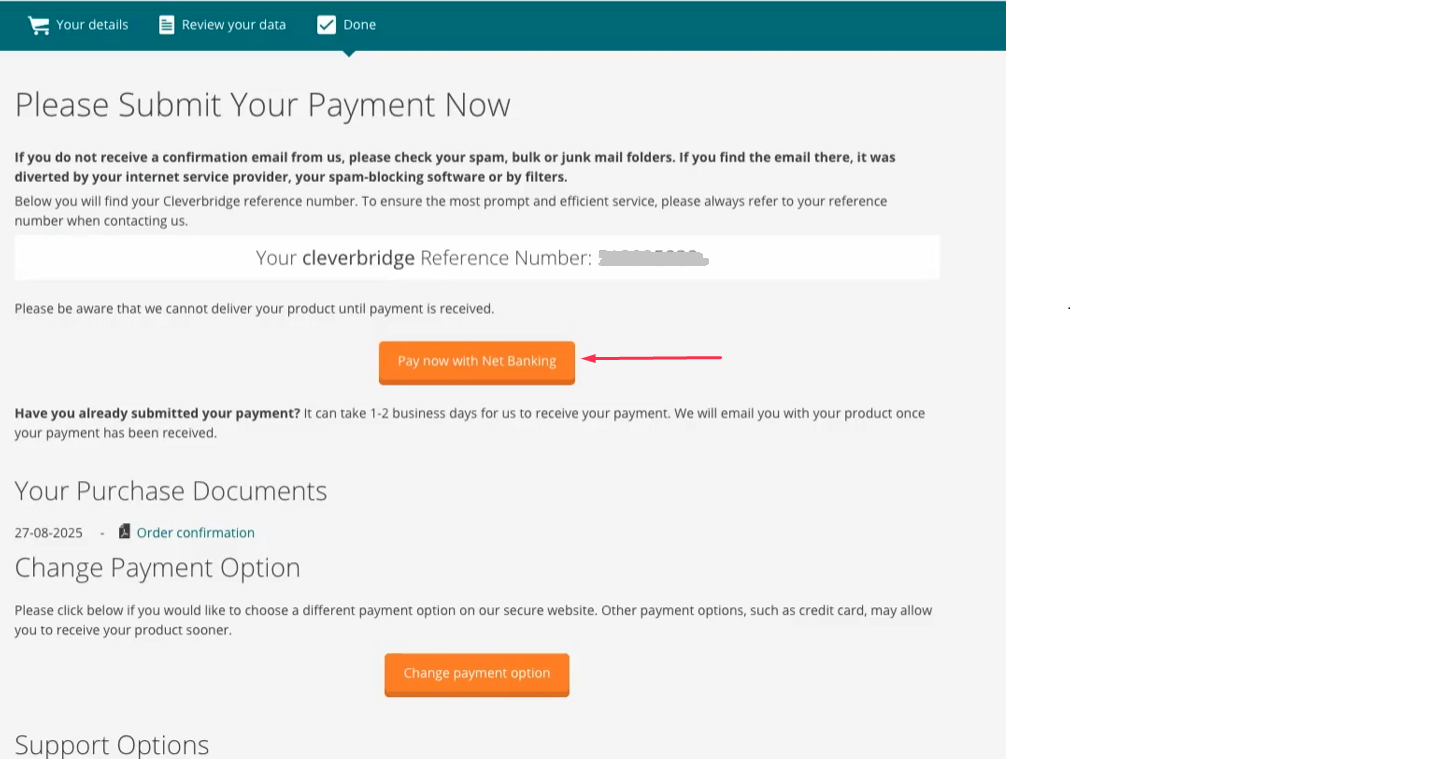

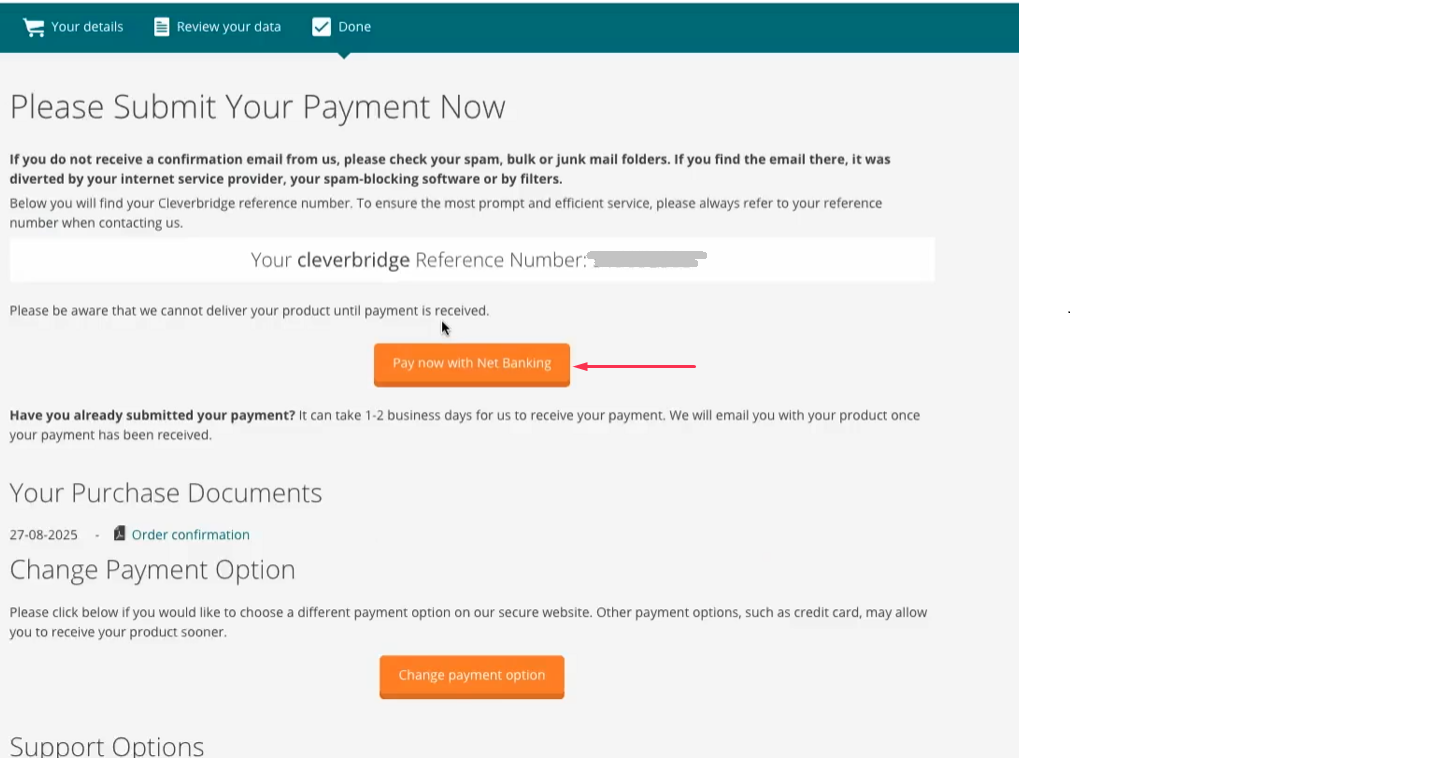

When the customer confirms the order, Cleverbridge creates the purchase and sets the status to Awaiting Offline Payment. - The customer submits the payment to continue.

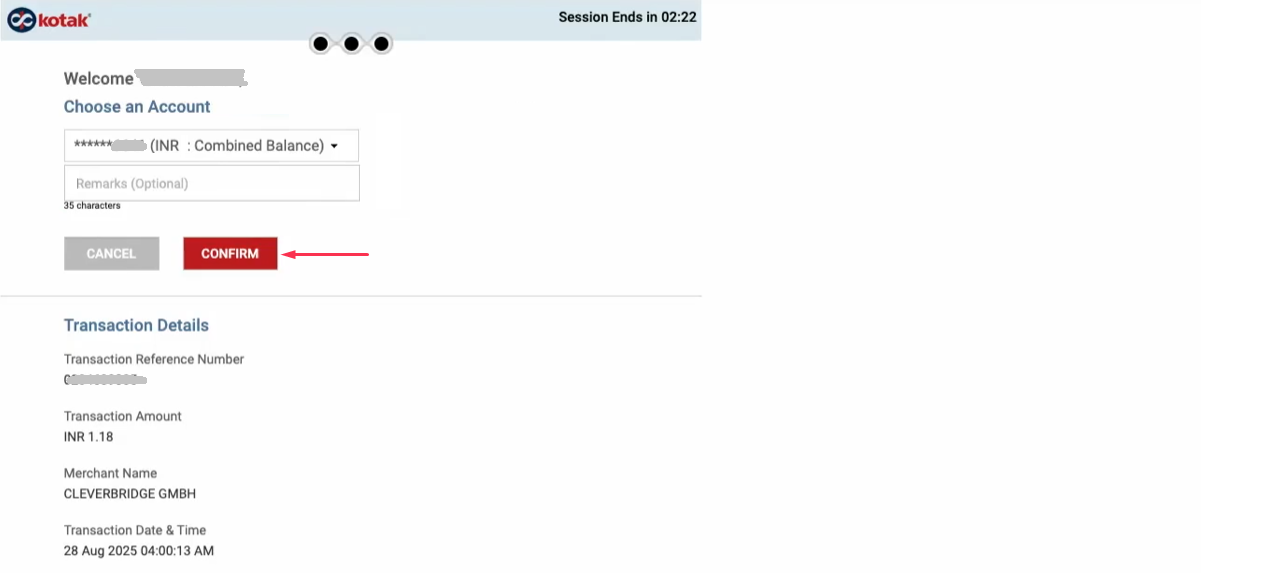

- The customer is redirected to the bank portal. Following the log-in, the customer is requested to confirm the payment.

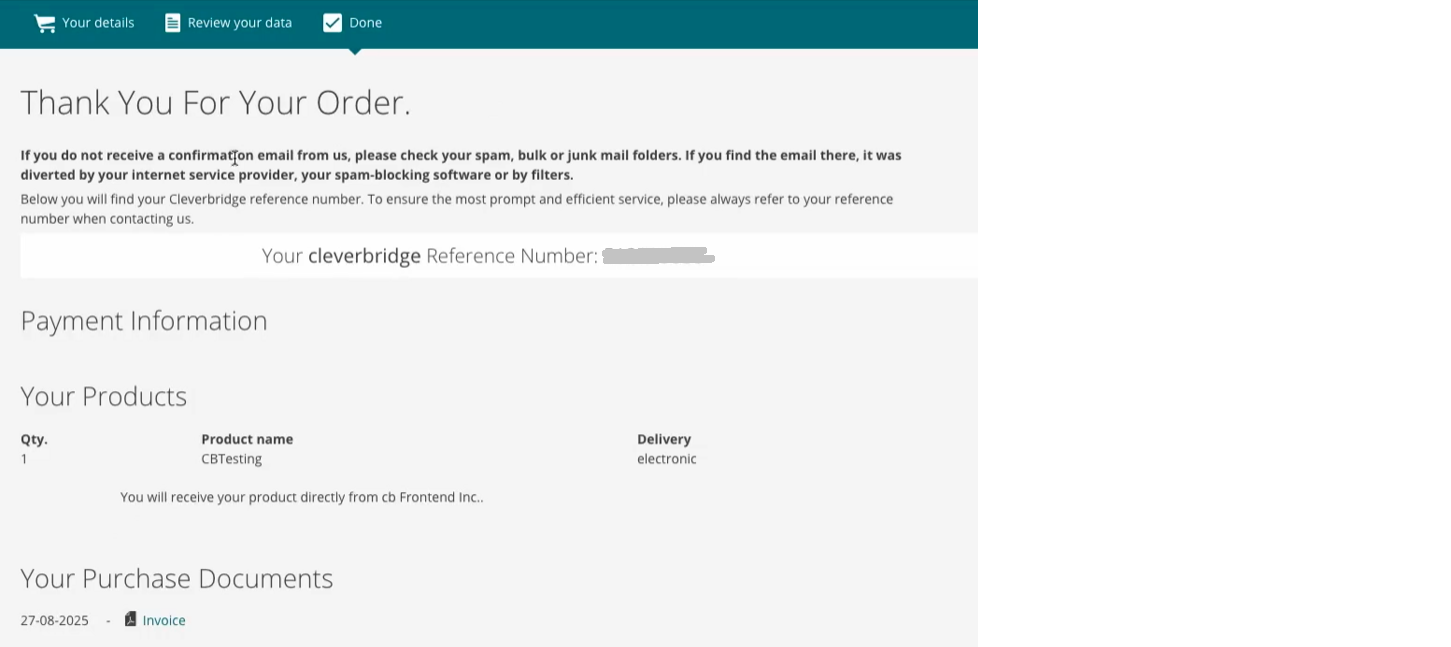

- Cleverbridge automatically updates the order to Paid, and the customer is redirected back to the Cleverbridge confirmation page.

In some cases, the confirmation page might not update automatically. If so, the customer should refresh the page to see the latest status.

Processing is typically proceeds within a few seconds. The method is supported by 85+ banks.

To enable recurrent payments, the customer authenticates via online banking to create an eNACH mandate:

- As well as for single purchases, the Cleverbridge checkout, the customer selects NetBanking payment option, and defines the bank to make the payment through. To enable subscription payments, the customer also needs to enter the required account details including the Account number, Holders name, and Account type.

noteWhen entering bank details, the customer must select the correct Account type. The supported values are Current and Savings. The customer should choose the option that matches the account they are using with their bank.

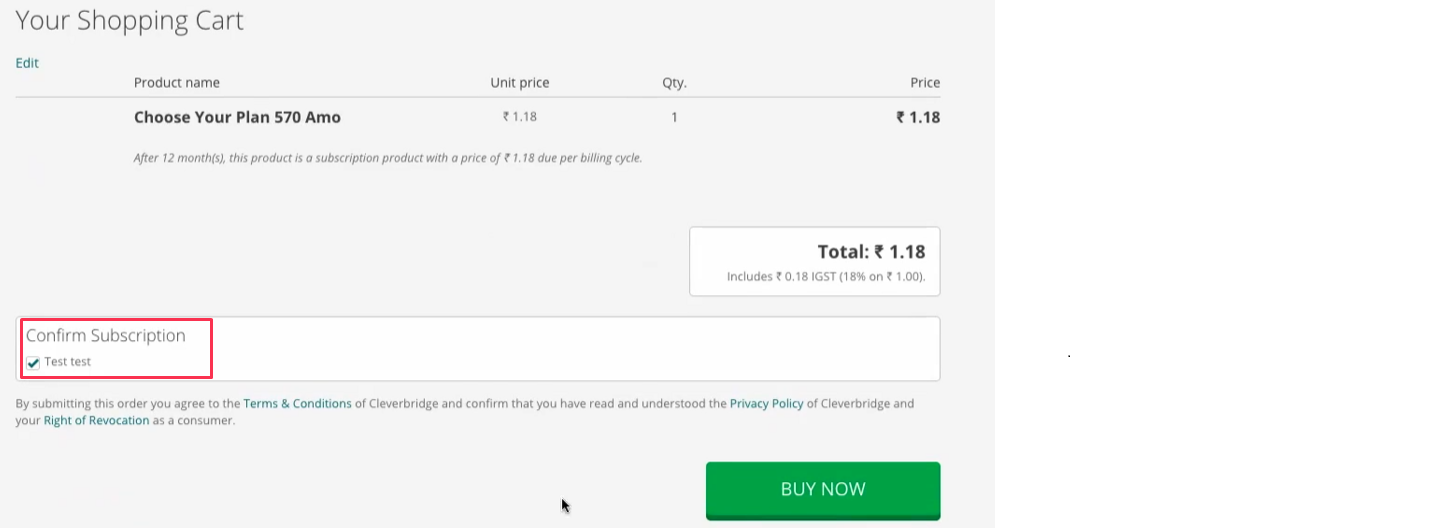

- The customer reviews the order, confirms the subscription details, and proceeds further.

When the customer confirms the order, Cleverbridge creates the purchase and sets the status to Awaiting Offline Payment. - The customer submits the payment to continue.

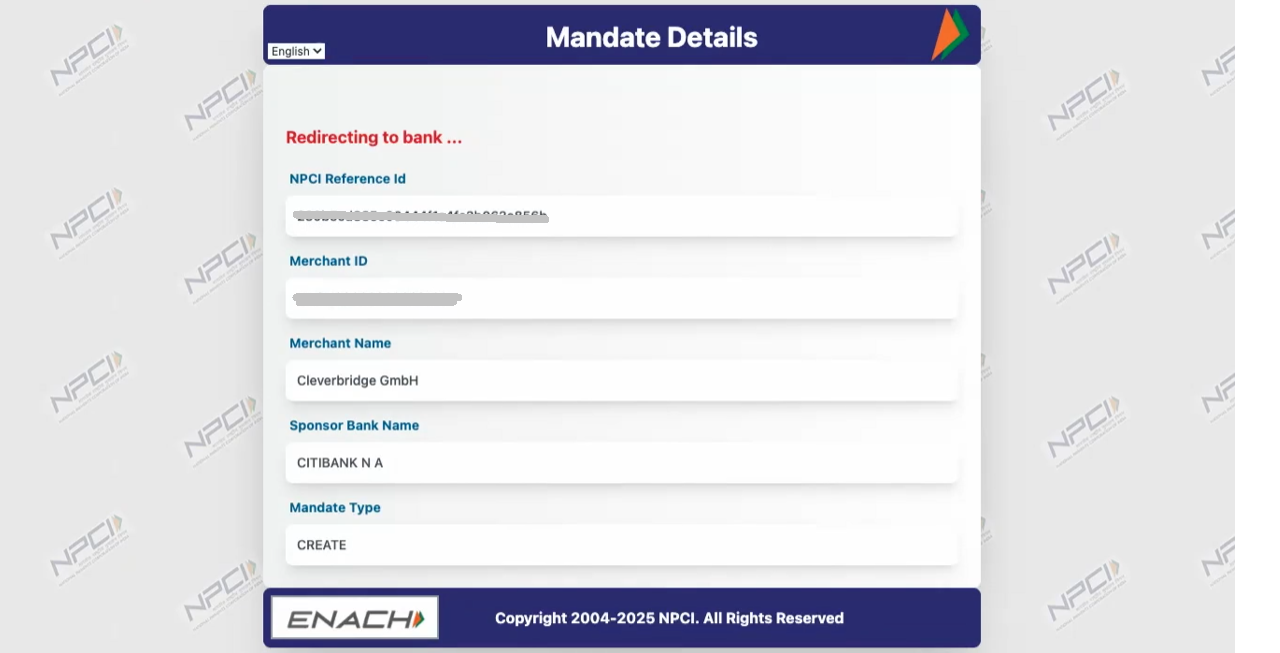

- The customer is redirected to National Payments Corporation of India's (NPCI) page, where the mandate details are displayed.

important

importantThe NPCI page is accessible only from an Indian IP address. While no action is required from the customer on the NPCI page, it is necessary to access it to be automatically redirected to their bank login page.

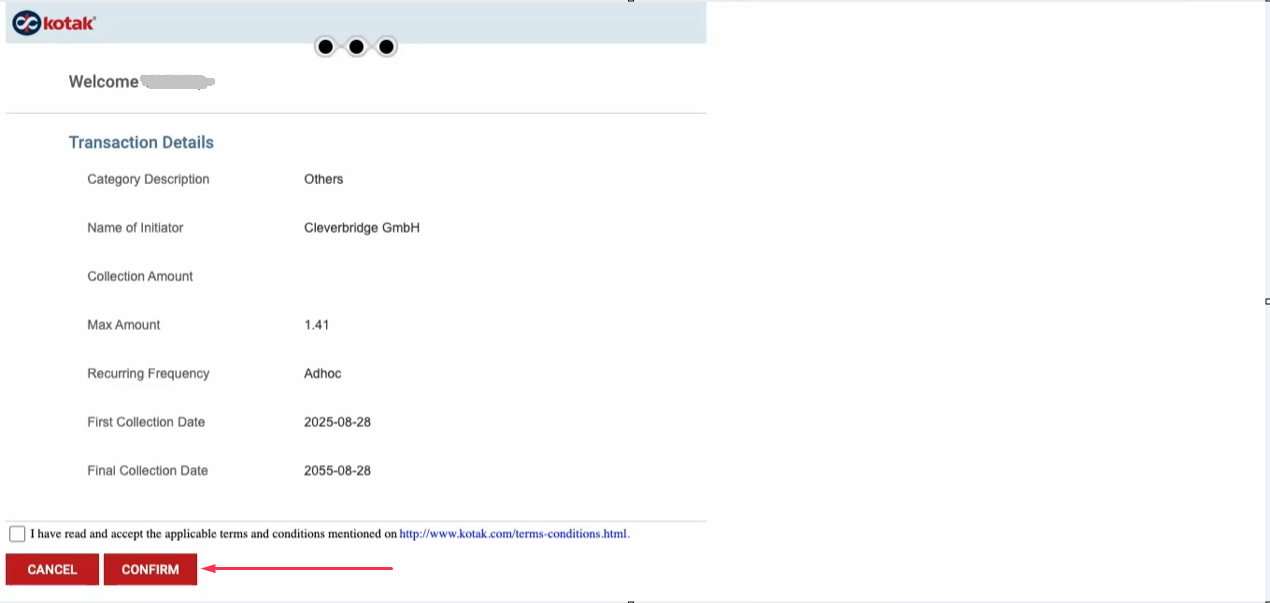

- The customer is redirected to the bank portal. Following the log-in, the customer is requested to confirm the payment.

At this stage, a mandate is created.noteThe confirmation request defines the maximum amount that includes buffer to incorporate in the mandate for any price changes in the future.

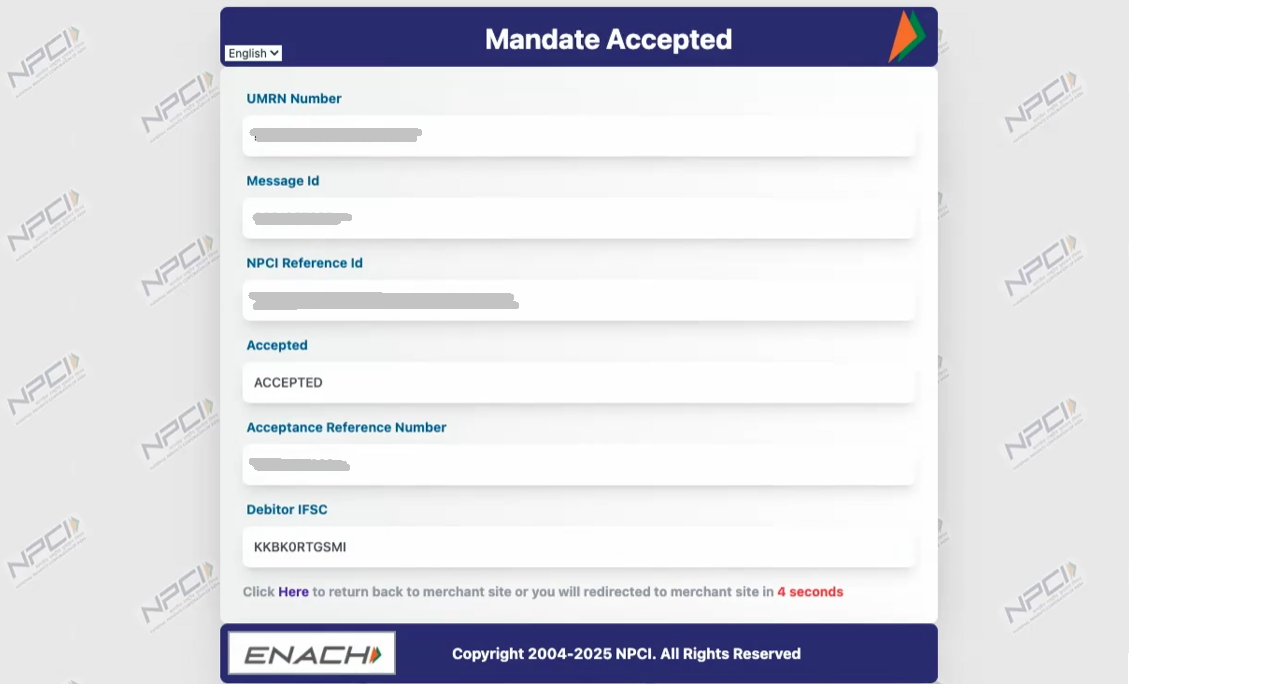

- Following the confirmation, the customer is automatically redirected back to the NPCI page with the Mandate Accepted message. Along with other details, the message contains UMRN (Unique Mandate Reference Number) of the mandate.

No action is required from the customer on the NPCI page.

No action is required from the customer on the NPCI page. - The customer is automatically redirected to the Purchase Confirmation page.

- Payments made before 12 pm IST are usually reported within 24 hours, while payments made after 12 pm IST are typically reported within 1-2 business days. At this point, the purchase remains Awaiting Offline Payment.

important

Customers should not submit the payment again, while the order is being processed, as this can result in duplicate debits.

- After the settlement, which usually takes one or two banking days, the purchase status automatically updates to Paid.

Understanding eNACH

eNACH is the electronic version of National Automated Clearing House (NACH) Mandate used in India to set up recurring debits directly from a customer’s bank account. The customer completes a one-time mandate creation with their bank; future renewals are then debited automatically under the approved mandate.

Each mandate is assigned a Unique Mandate Reference Number (UMRN): a system-wide identifier for the eNACH mandate.

- Mandate amount* can differ from the subscription amount and include a configurable buffer to accommodate future price changes. See the Mandate amount adjustment below for more details.

- Tenor: Mandates can be created for up to 30 years.

- Maximum mandate cap: INR 10,000,000

- Maximum single transaction: INR 2,500,000

A dedicated mandate is issued for each subscription.

The method is supported by at least 55 different banks in India.

Mandate amount adjustments

Mandate amount can be buffered and rounded based on the needs of each specific Cleverbridge client account:

-

Buffering: The mandate amount includes a configurable buffer to accommodate price changes, currency fluctuations, and similar adjustments. In other words, charges that exceed the initial amount within this defined buffer will be processed without failure and with no need to create a new mandate. The default buffer is 20%, but it can be turned off or set to any percentage upon client's request to Cleverbridge.

-

Rounding: The amount can be rounded up to the nearest ceiling value of 10^n. The default n is 4 (that is, round to the next 10,000), but clients can choose a different n, or disable rounding entirely.

Buffering and rounding can be configured independently; either can be enabled without the other. If both are enabled, buffering is applied first, then rounding.

- INR 3,000 → +20% = 3,600; with n = 4, rounds up to 10,000.

- INR 35,000 → +20% = 42,000; with n = 4, rounds up to 50,000.

- INR 123,000 → +20% = 147,600; with rounding, becomes 150,000.

The settings are defined based on the client's request to our Client Experience team.

Handling refunds

- One-time Net Banking payments are supported through the standard Cleverbridge refund flow: Refunds are returned to the original payment method and the refund status updates on the order once confirmation is received from the provider.

- Subscription (eNACH) refunds are not supported by PSP at this time and must be handled manually.

Refund timelines depend on bank processing; customers may see funds only after their bank completes processing. Do not ask the customer to attempt payment again while the order is Awaiting Offline Payment to avoid duplicate debits.