Payment analytics

The Analyze > Payments dashboard compiles key metrics to deliver valuable insights into your payment processes, enabling you to make timely, informed decisions based on both recognized trends and emerging patterns. With this data, you can effectively address critical business questions, such as:

- Which payment methods generate the highest revenue.

- How payment success rates are trending over time.

- Which credit card schemes deliver the best authorization rates.

- How Cleverbridge revenue retention tools impact your revenue streams.

To learn more about the revenue retention tools see Collect failed online payments automatically.

Payments provide data to be used only as a reference. If you want to generate reports for accounting purposes, use the clearing reports available in Commerce Assistant.

Access payment analytics

You can access the reports based on these metrics in Analyze > Payments dashboard after you have successfully completed the onboarding process. For more information, contact Client Experience.

Payment metrics and reports

Analysis of the payment metrics is allocated into several pages based on the phases of payment processing and revenue optimization.

- Payment Success: Helps you understand how many submitted orders result in successful payments and how much net revenue they generate.

- Purchase Authorization: Helps you evaluate credit card authorization performance and the impact of Cleverbridge retention tools on successful transactions.

- Revenue Recovery: Helps you measure the revenue saved by tools like Account Updater, Expiration Date Checker, rerouting, and retry logic.

- Card Acceptance: Helps you analyze the performance of card payments across fraud checks, 3DS authentication, and final payment outcomes.

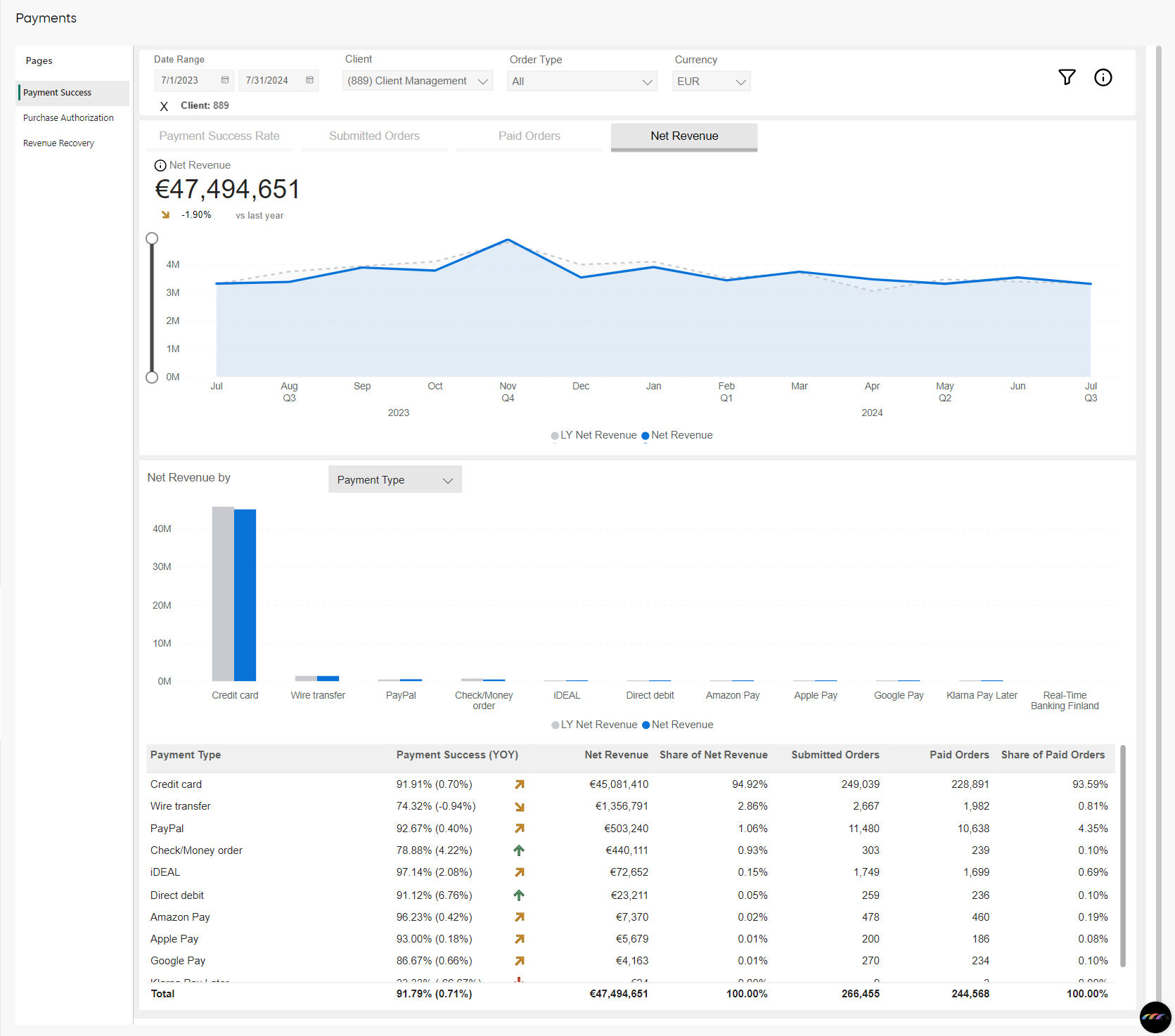

Payment Success page

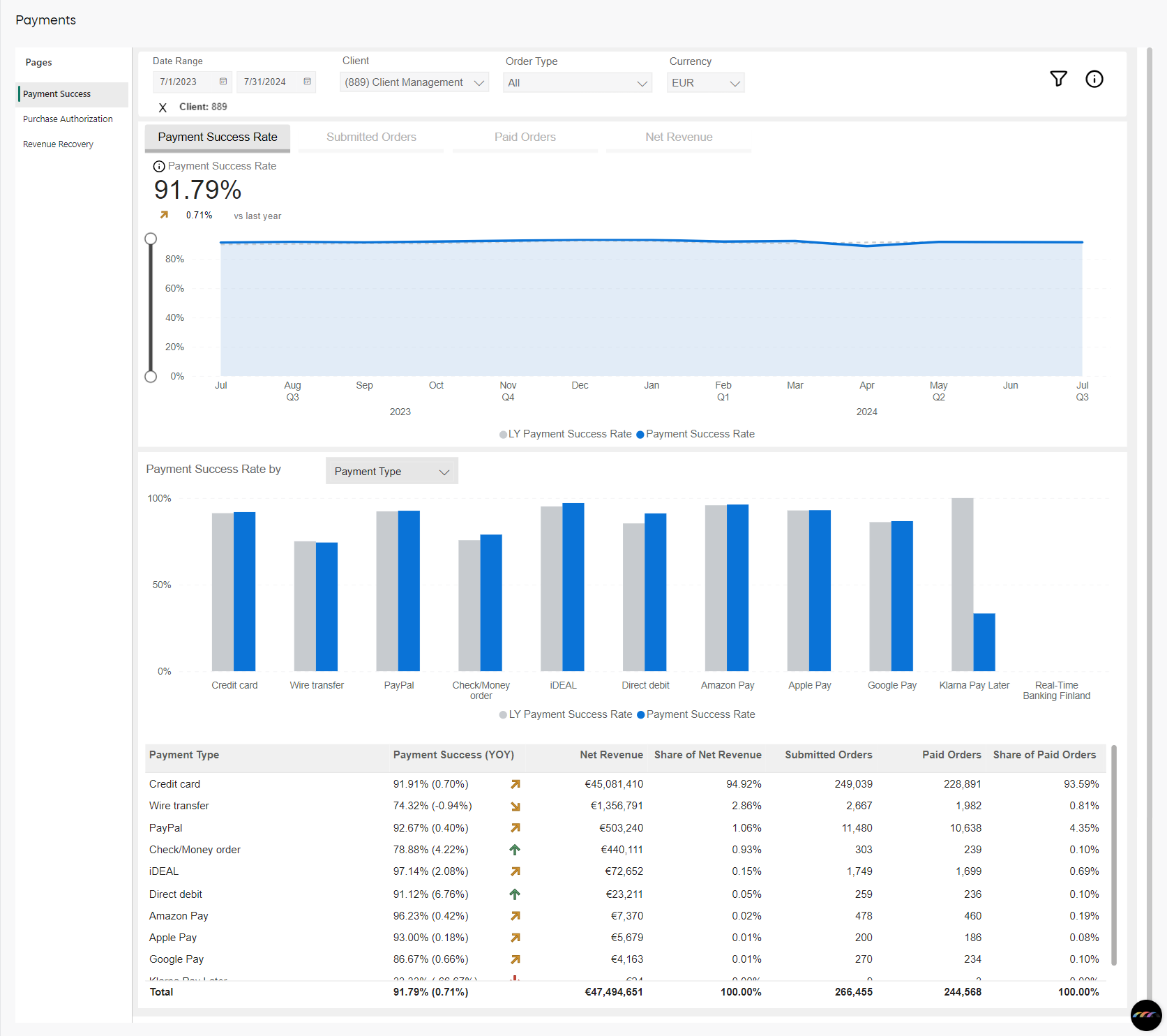

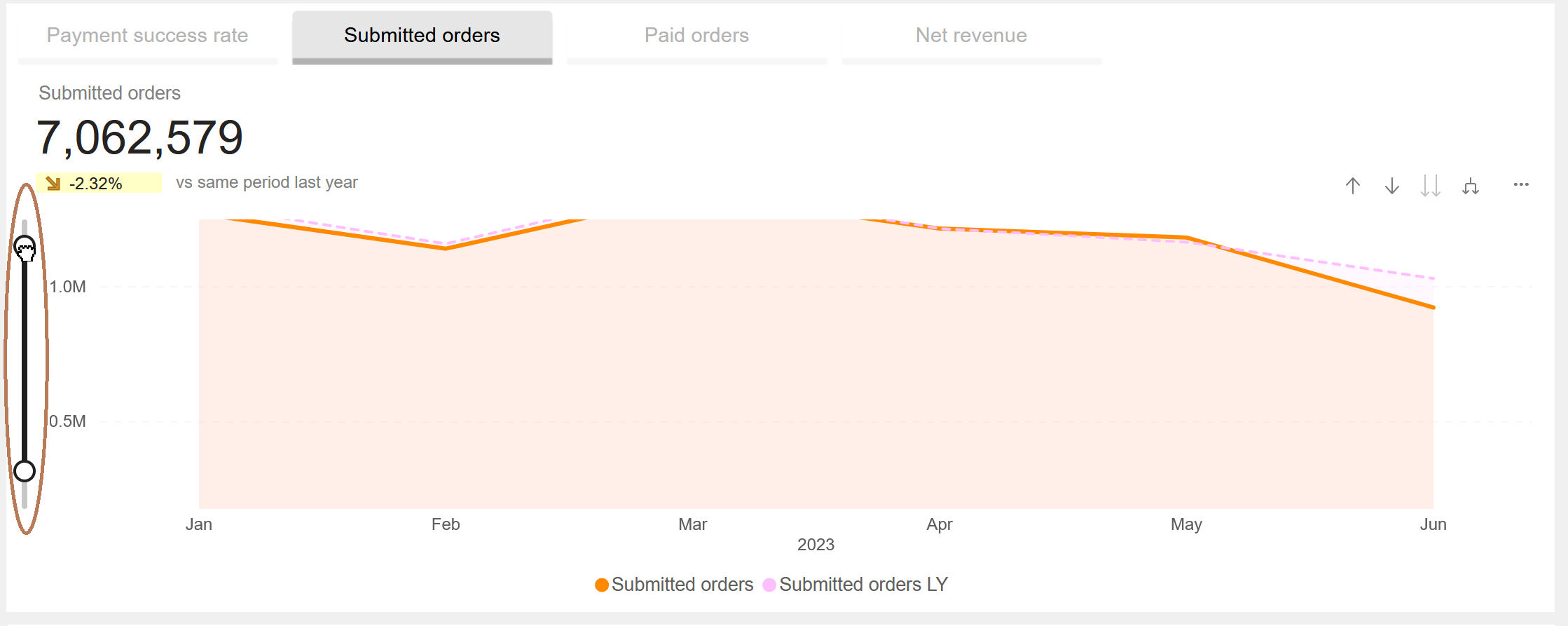

The Payment Success page contains of four tabs that offer a deep dive into the elements of the payment success rate, meaning submitted orders, paid orders, and net revenue.

Payment Success Rate

Payment success rate measures the number of orders that have been successfully paid, divided by all submitted orders. Successfully paid orders include those where a refund or chargeback was processed after the payment.

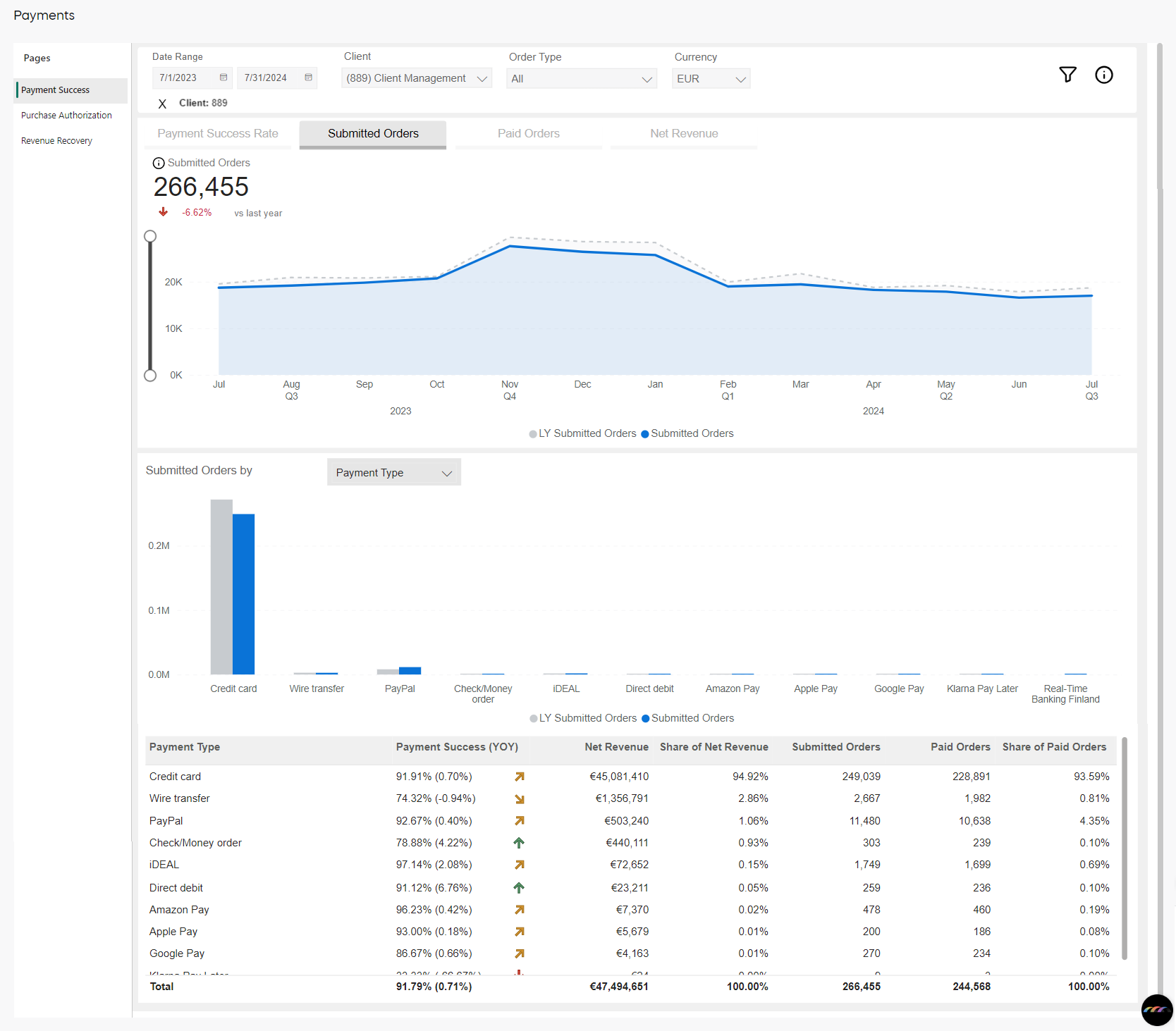

Submitted Orders

Submitted orders refer to successfully created orders for which payment details were received by Cleverbridge. Orders that underwent a refund or chargeback after payment are also included.

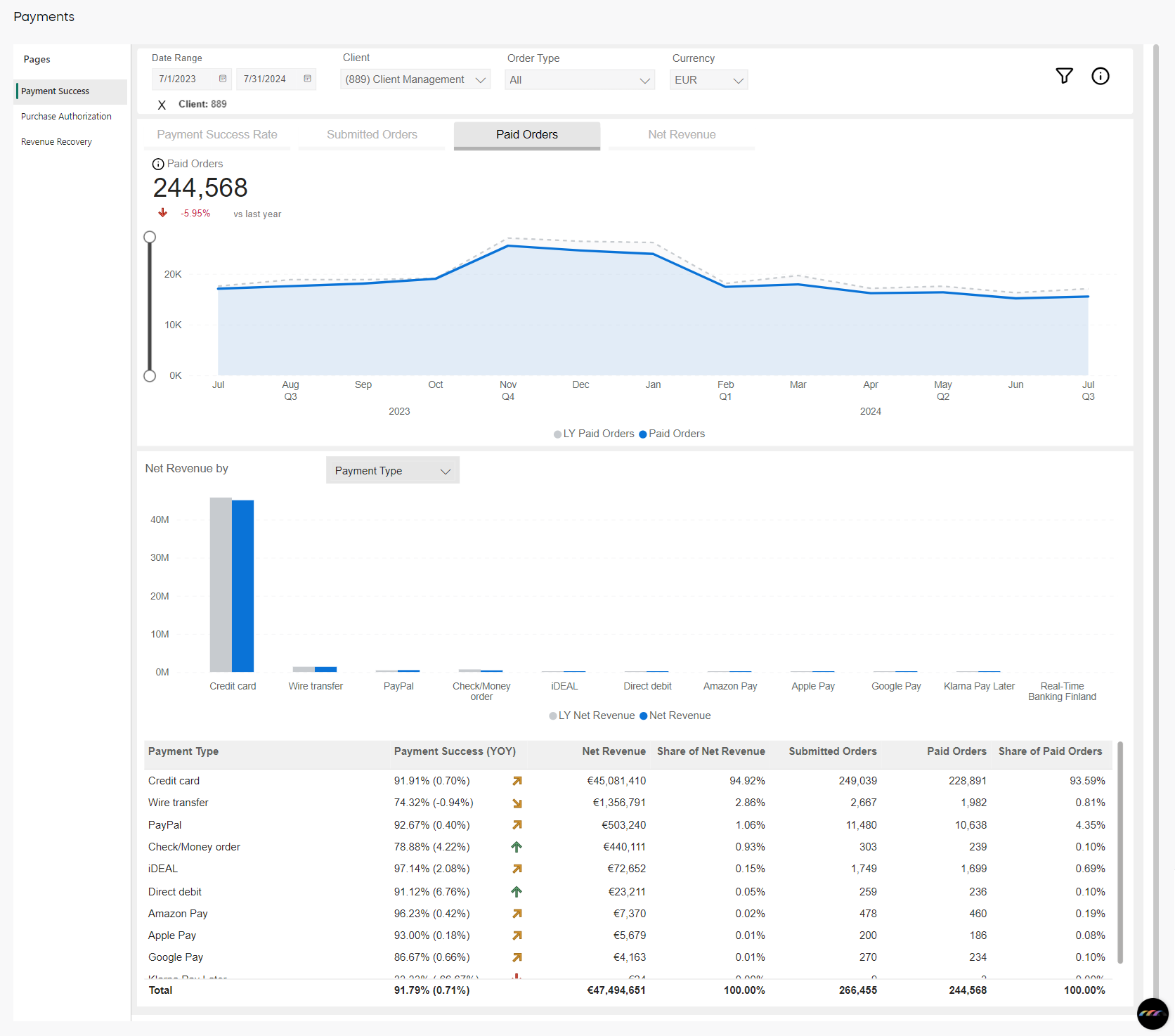

Paid Orders

Paid orders are orders that have been successfully processed, with payment received and product delivery information dispatched. Successfully paid orders also include those where a refund or chargeback was processed after the payment.

Net Revenue

Net revenue represents the amount generated by paid orders, calculated based on the exchange rate at the time of the transaction. All discounts and shipping costs are subtracted, while Cleverbridge fees and affiliate commissions are included.

If a chargeback or refund occurs, the net revenue amount is reduced by the corresponding order amount.

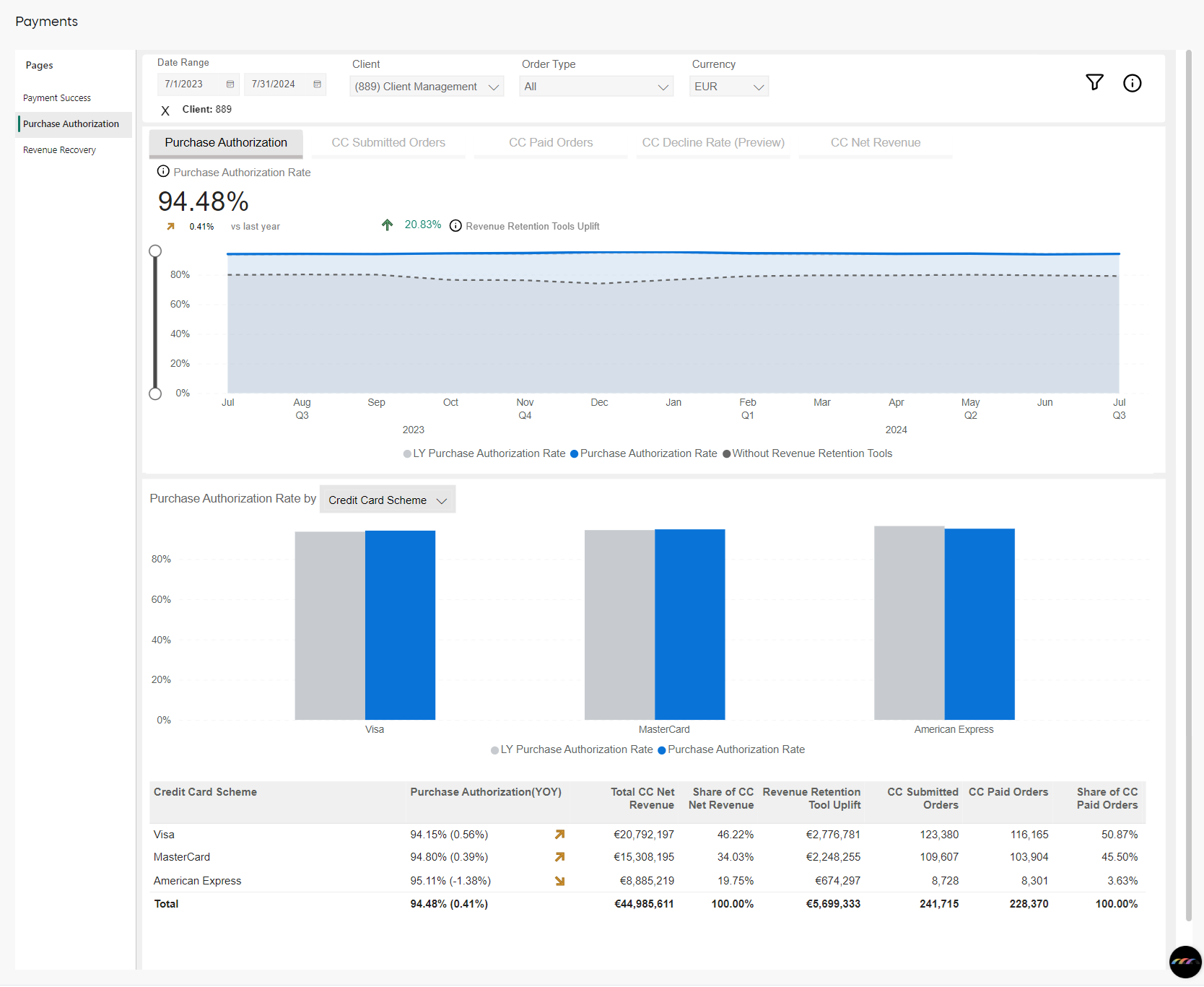

Purchase Authorization page

The Purchase Authorization page includes information on purchase authorization rates, submitted orders, paid orders, and net revenue, along with historical data for comparison.

Purchase Authorization Rate

The Purchase Authorization Rate measures the number of successfully paid orders divided by all submitted orders. Successfully paid orders include those where a refund or chargeback was processed after the payment.

A purchase success rate of 100% would indicate that out of 100 incoming orders, 100 led to a successful order that at some point switched to the Paid status. A purchase success rate of 50% therefore would mean that out of 100 incoming orders, 50 were successfully processed and paid at some point, whereas the other half would have not been successful (for example, when the credit card was declined by a card issuer).

The Purchase Authorization Rate graph displays the following data:

- Purchase Authorization Rate for the selected period and the same period last year

- Revenue Retention Tools Uplift which is a percentage increase in revenue or orders achieved by leveraging Cleverbridge retention tools such as Account Updates, Expiration Date Checker, Dynamic Re-routing, and Automatic Retry.

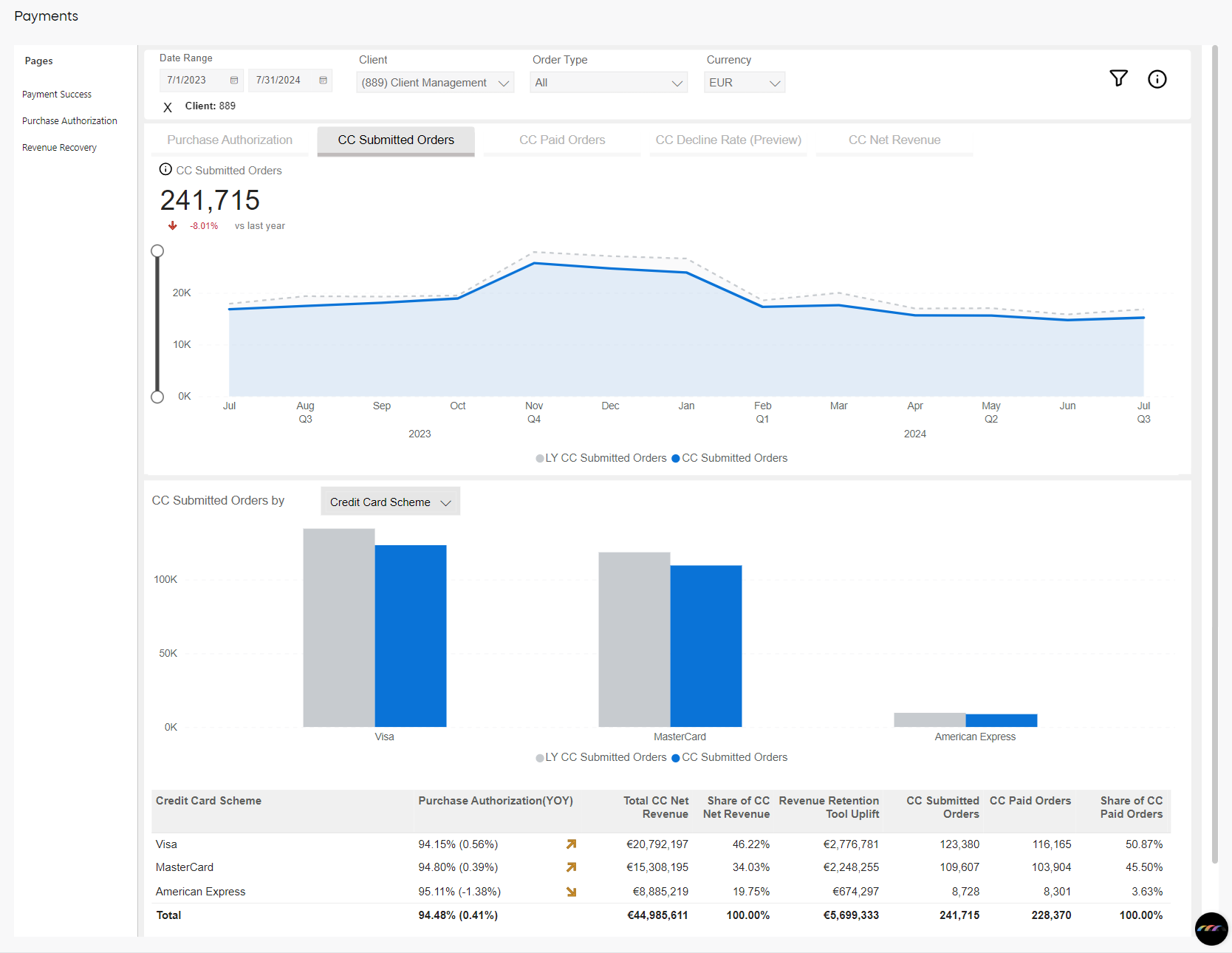

CC Submitted Orders

Number of credit card orders that have been submitted to our PSPs for authorization. Orders that have been blocked for fraud or export compliance and orders that did not pass 3DS authentication are excluded.

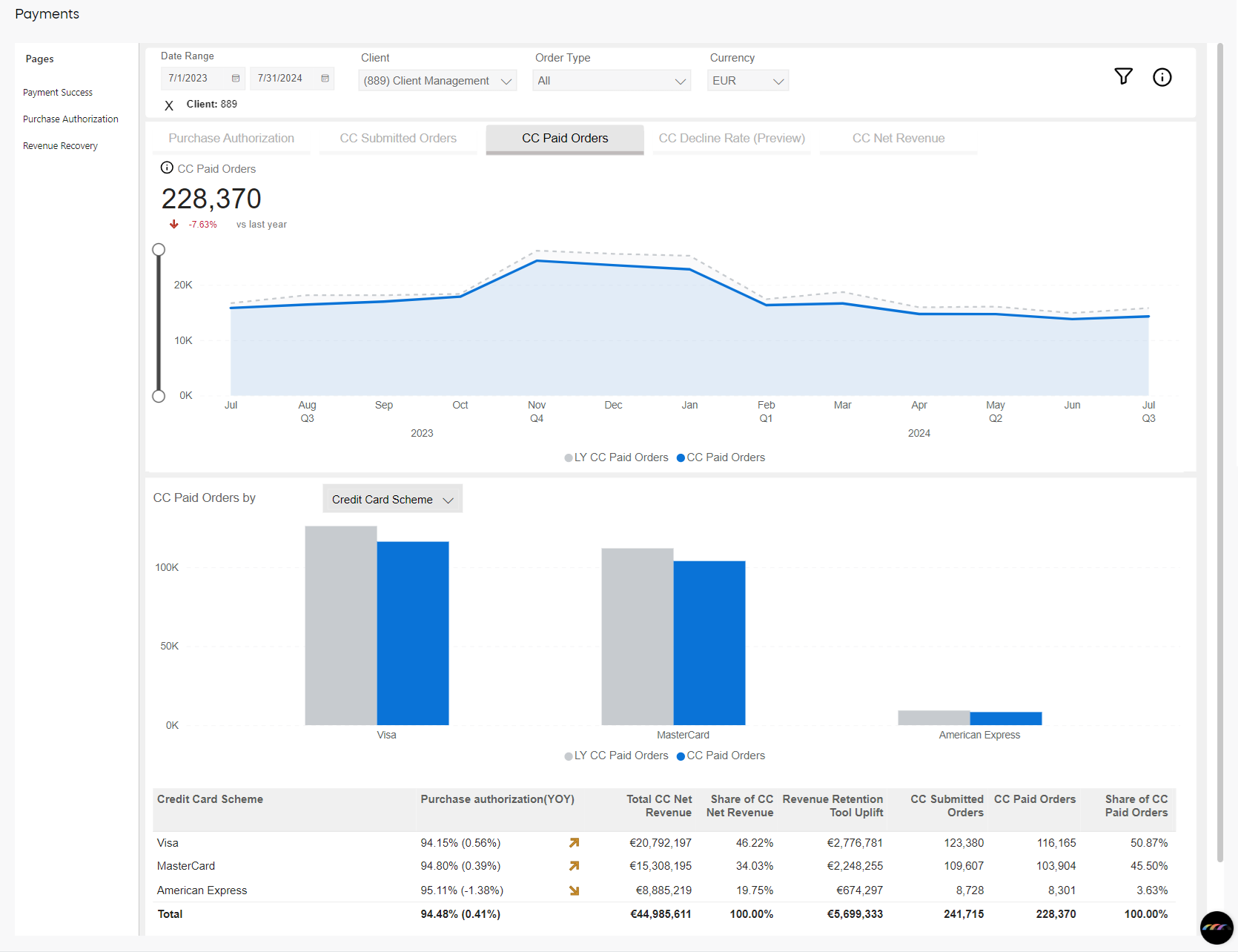

CC Paid Orders

A paid order is an order that has been successfully processed, with payment received and product delivery information dispatched. Successfully paid orders also account for those where a refund or chargeback was processed after the payment.

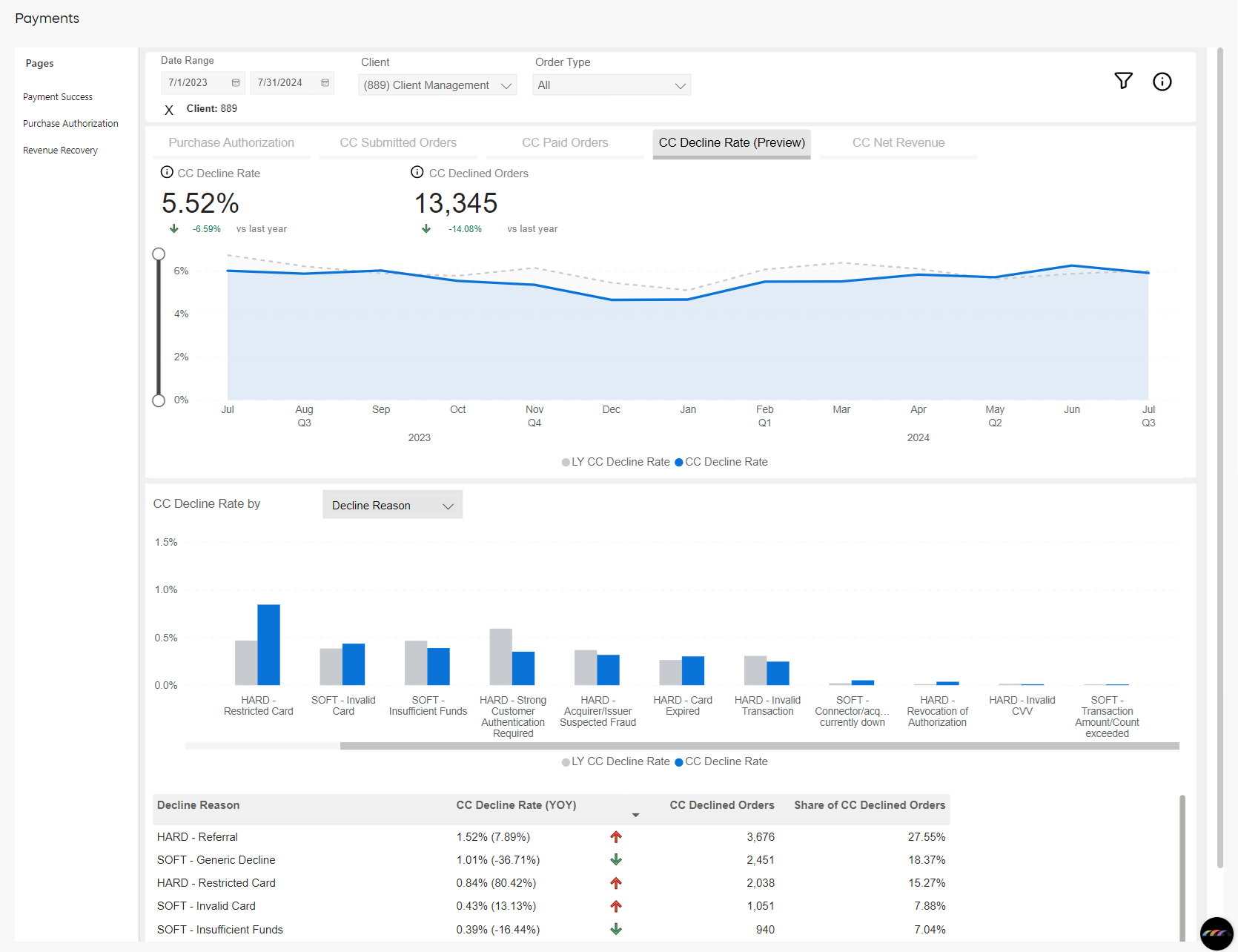

Decline Rate

The Decline Rate represents the percentage of submitted credit card purchases that are declined by card issuers. It is calculated by dividing the number of declined orders by the total number of submitted orders. Since one order may involve multiple transactions with various decline reasons and types, the most recent one is applied.

There are three types of decline:

- Authentication decline, which occurs when transactions are enrolled in 3DS but not yet authorized. The reason for this decline is called Strong Customer Authentication.

- Hard decline, which occurs when the customer's bank refuses the payment for various reasons. Such decline is permanent and not recoverable. Cleverbridge is unable to assist with these declines. Possible reasons include:

- Card Expired: The transaction is declined due to an expired card.

- Acquirer/Issuer Suspected Fraud: The acquirer or issuer suspects the order is fraudulent.

- Restricted Card: The card cannot be used for this payment, possibly due to being reported as stolen or lost

- Invalid CVV: The provided CVV is incorrect.

- Invalid Transaction: The credit card cannot be processed for various reasons, such as restrictions based on country, currency, business type, or order volume.

- Referral: The credit card is marked as lost, stolen, or invalid by the customer. The customer is advised to enter a new card or contact their bank.

- Revocation of Authorization: The authorization was revoked either by the customer or their bank. The authorization must be represented.

- Soft decline, which occurs when the issuing bank initially approves the card but a payment process issue arises. Soft declines are temporary. We use revenue retention tools to recover them by addressing the root cause of the initial decline. Possible reasons include:

- Generic Decline: The transaction was declined by the customer's bank. We recommend the customer to contact their bank for further assistance or try using a different payment option.

- Insufficient Funds: The purchase is unsuccessful due to insufficient funds in the customer's account. We recommend to the customer to ensure their account has sufficient funds before attempting another transaction

- Transaction Amount/Count Exceeded: The transaction was declined as it exceeds the balance, credit limit, or transaction amount associated with the customer's card. We recommend to the customer to review their limit or consider an alternative payment option.

- Invalid card: The card or the associated account is invalid. We recommend to the customer to review the card details, or try a different payment option.

- Connector/Acquirer Currently Down: The transaction couldn't be processed as the corresponding connector or acquirer is temporarily unavailable. We recommend to the customer to try again later or choose an alternative payment option.

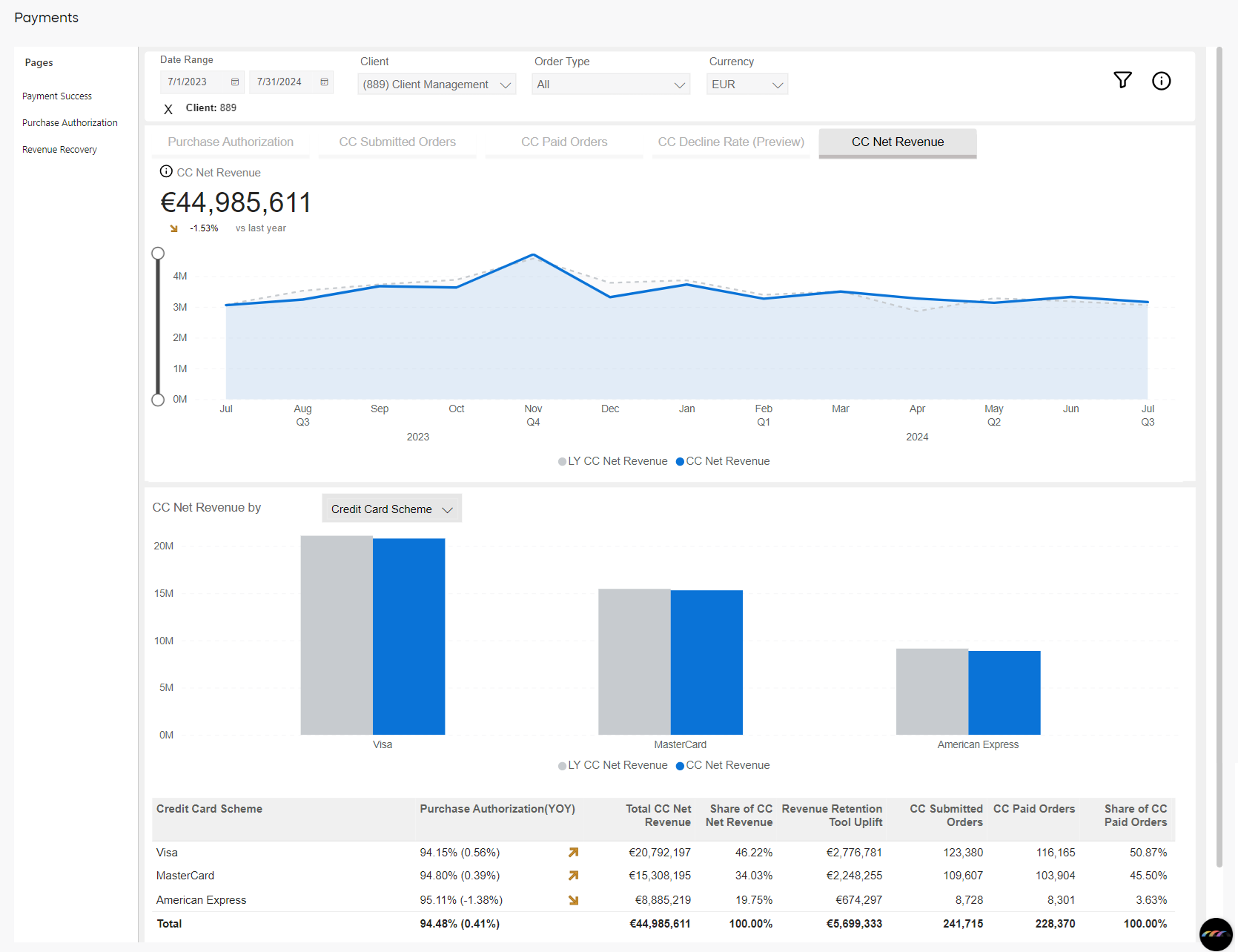

CC Net Revenue

Net Revenue reflects the amount generated by paid orders for credit cards, based on the exchange rate at the time of the transaction. All discounts and shipping costs are subtracted, while Cleverbridge fees and affiliate commissions are included.

If a chargeback or refund occurs, the net revenue amount is reduced by the corresponding order amount.

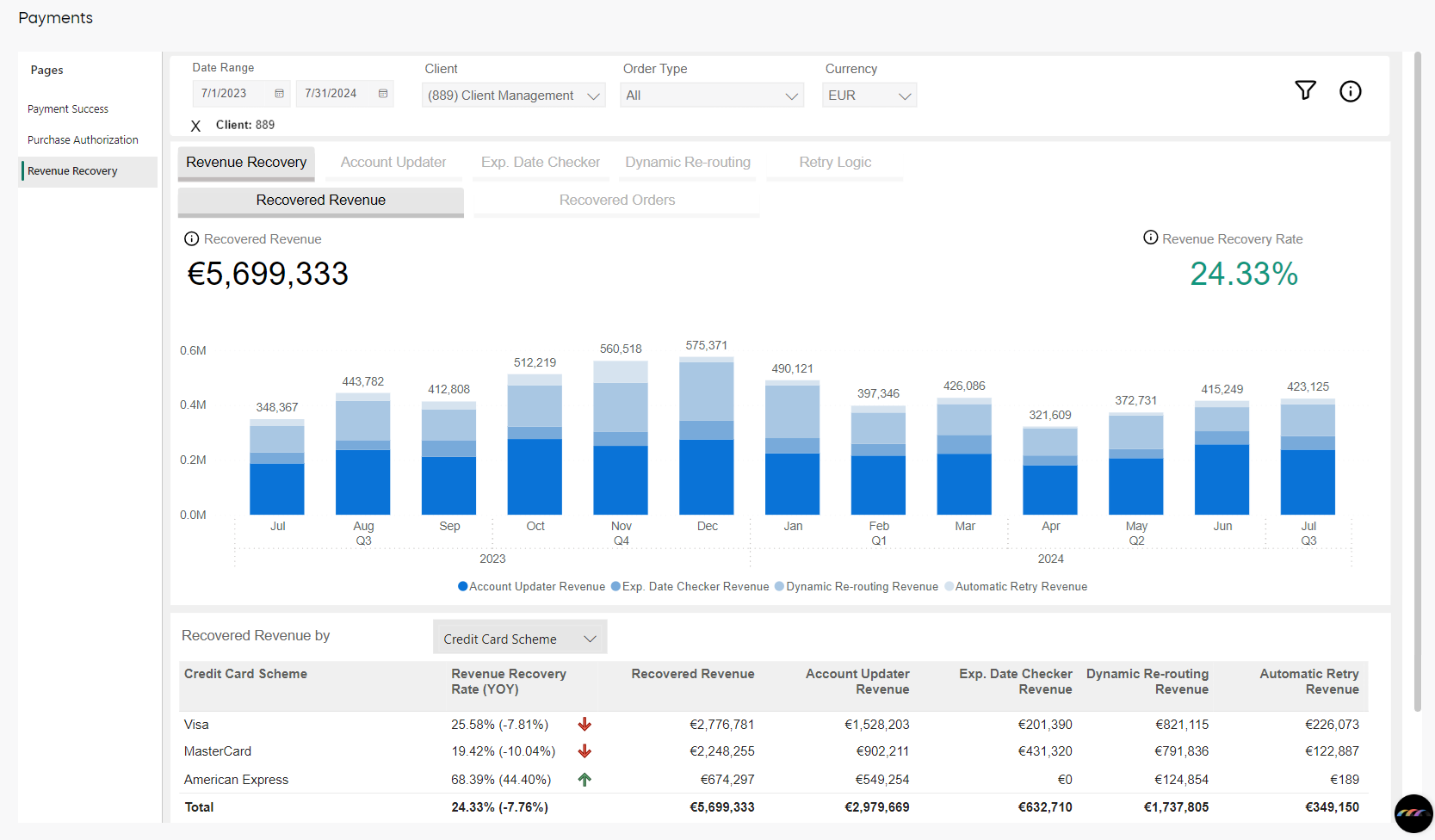

Revenue Recovery page

The Revenue Recovery page displays charts with information on the potential revenue loss prevented by Cleverbridge revenue retention tools. Those tools help you prevent payment failures and revenue churn that could happen due to outdated credit card details.

Revenue Recovery graphs

The Revenue Recovery graphs provide insights into recovered renewal revenue and recovered renewal orders, showcasing data related to revenue generation and the number of orders that were successfully recovered through various mechanisms, such as card updates, expiration date checks, rerouting, and automatic retries.

The Revenue Recovery graphs are:

Recovered Revenue

The Recovered Revenue graph displays the following data:

- Account Updater Revenue: Revenue of orders with updated cards, which could be converted into renewals, during the selected period.

- Exp. Date Checker Revenue: Revenue generated from orders that were successfully renewed after updating their expiration dates using the Expiry Date Checker.

- Dynamic Re-routing Revenue: Revenue derived from orders rerouted and delivered to secondary acquirers due to the initial unsuccessful attempt to deliver them to primary acquirers. Acquirers, in this context, are banks or financial institutions that process credit or debit card payments on behalf of Cleverbridge.

- Retries Revenue: Revenue generated from orders where our retry logic was successfully applied, indicating that we were able to reprocess failed payments after specific intervals. This revenue includes PayPal Retries, as well as Self Service Retries. This retry logic is applied to renewal payments only.

- Partner Retries Revenue: Revenue generated from partner retries—retry attempts that are not initiated by the Cleverbridge retry logic, whether static or dynamic, but instead by a Cleverbridge partner.

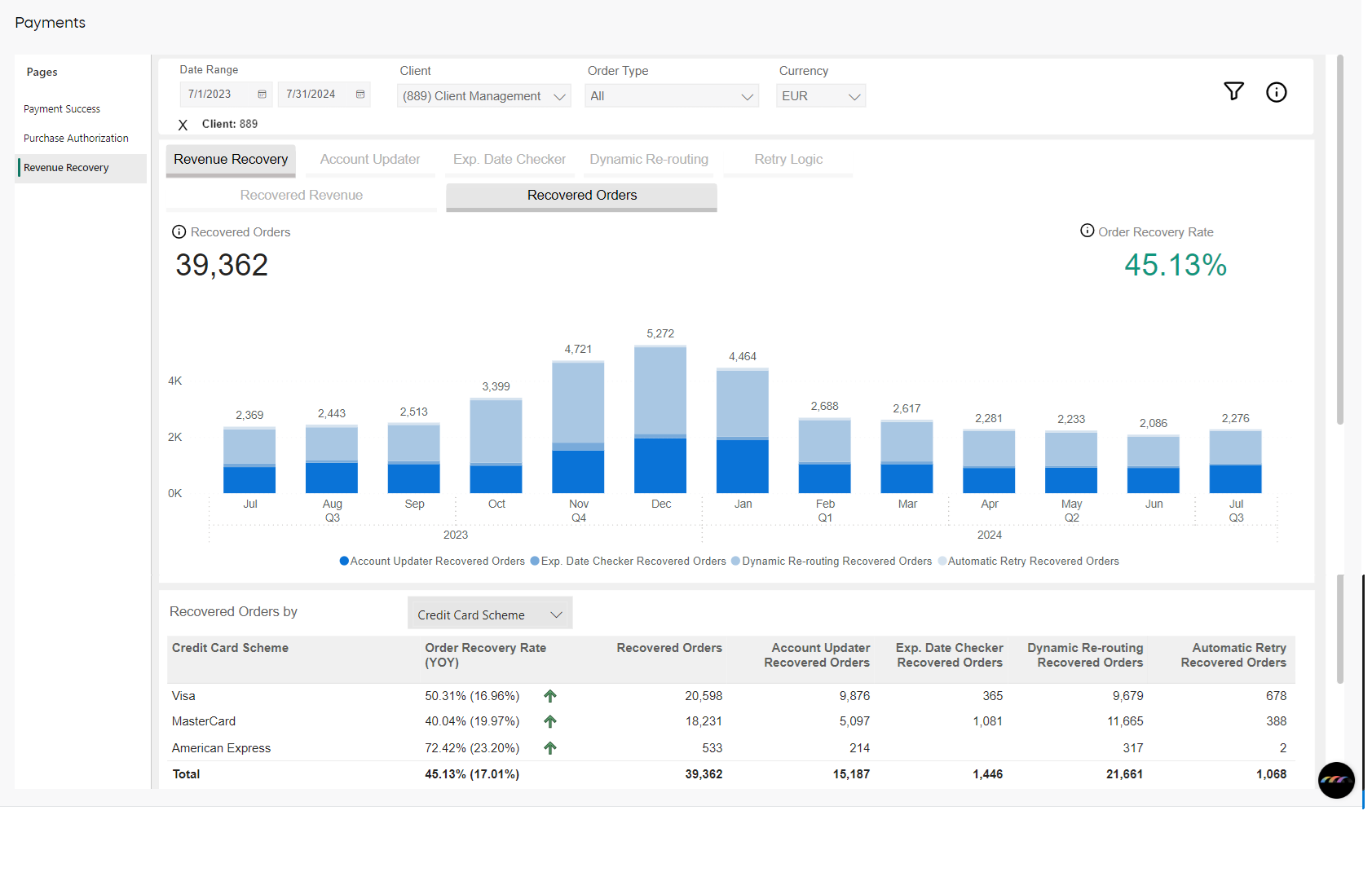

Recovered Orders

The Recovered Orders graphs displays the following data:

- Account Updater Recovered Orders: Number of orders with updated cards, which could be converted into renewals, during the selected period.

- Exp. Date Checker Recovered Orders: Number of renewals generated from orders that were successfully renewed after updating their expiration dates using the Expiration Date Checker.

- Dynamic Re-routing Recovered Orders: Number of orders rerouted and delivered to secondary acquirers due to the initial unsuccessful attempt to deliver them to primary acquirers. Acquirers, in this context, are banks or financial institutions that process credit or debit card payments on behalf of Cleverbridge.

- Retries Recovered Orders: Number of orders where our retry logic was successfully applied, indicating that we were able to reprocess failed payments after specific intervals. This value includes PayPal Retries, as well as Self Service Retries. This retry logic is applied to renewal payments only.

- Partner Retries Recovered Orders Number of orders recovered from partner retries—retry attempts that are not initiated by the Cleverbridge retry logic, whether static or dynamic, but instead by a Cleverbridge partner.

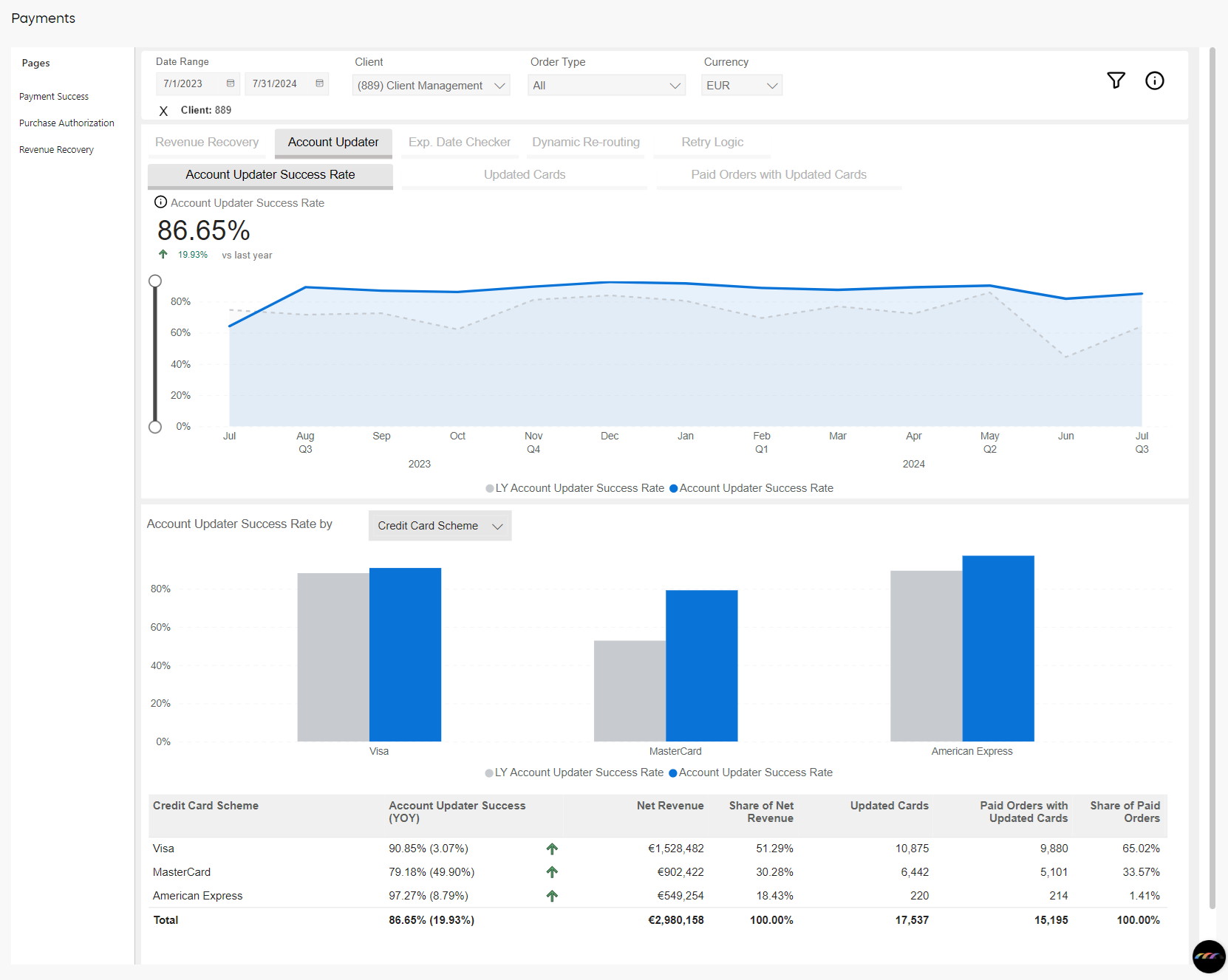

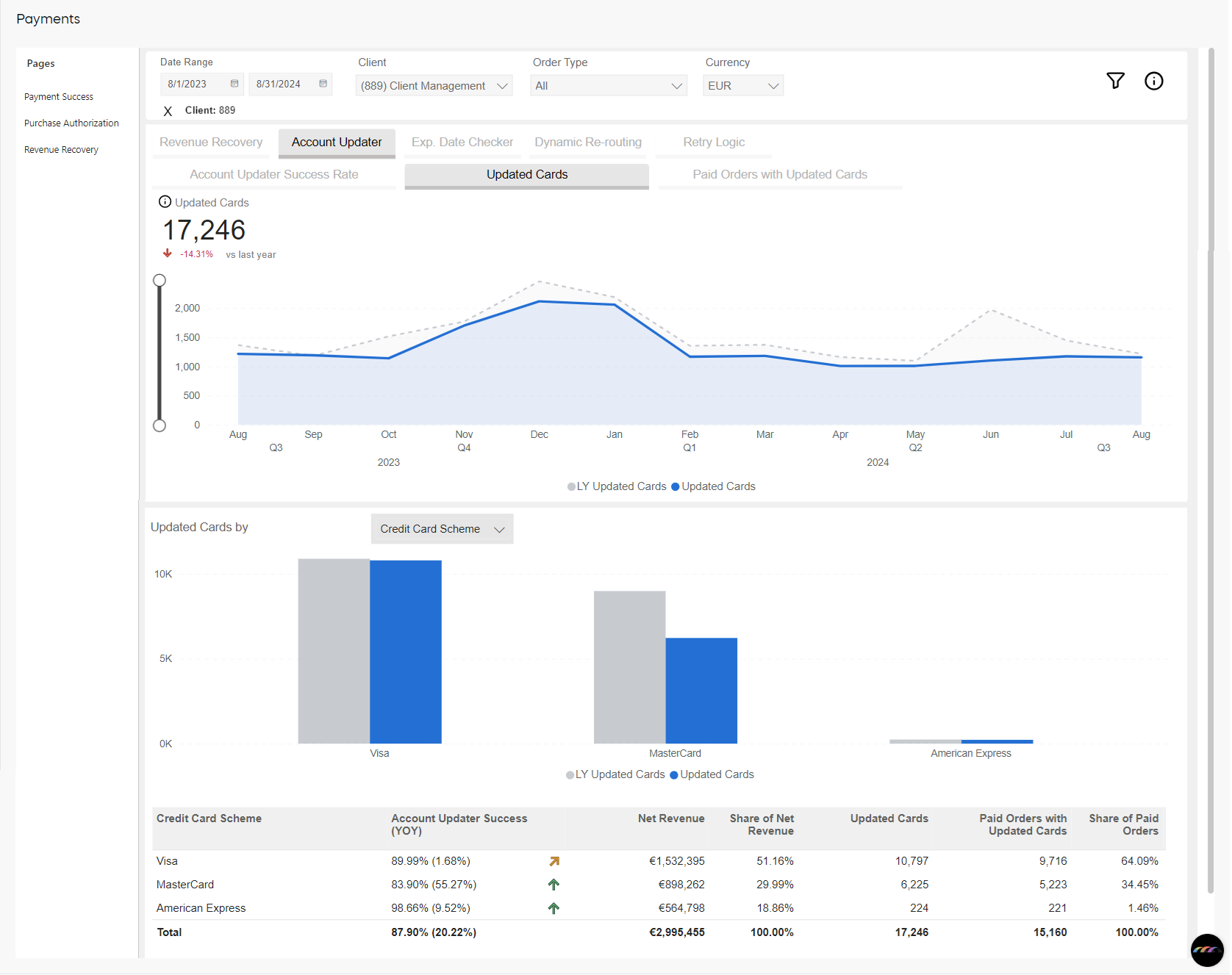

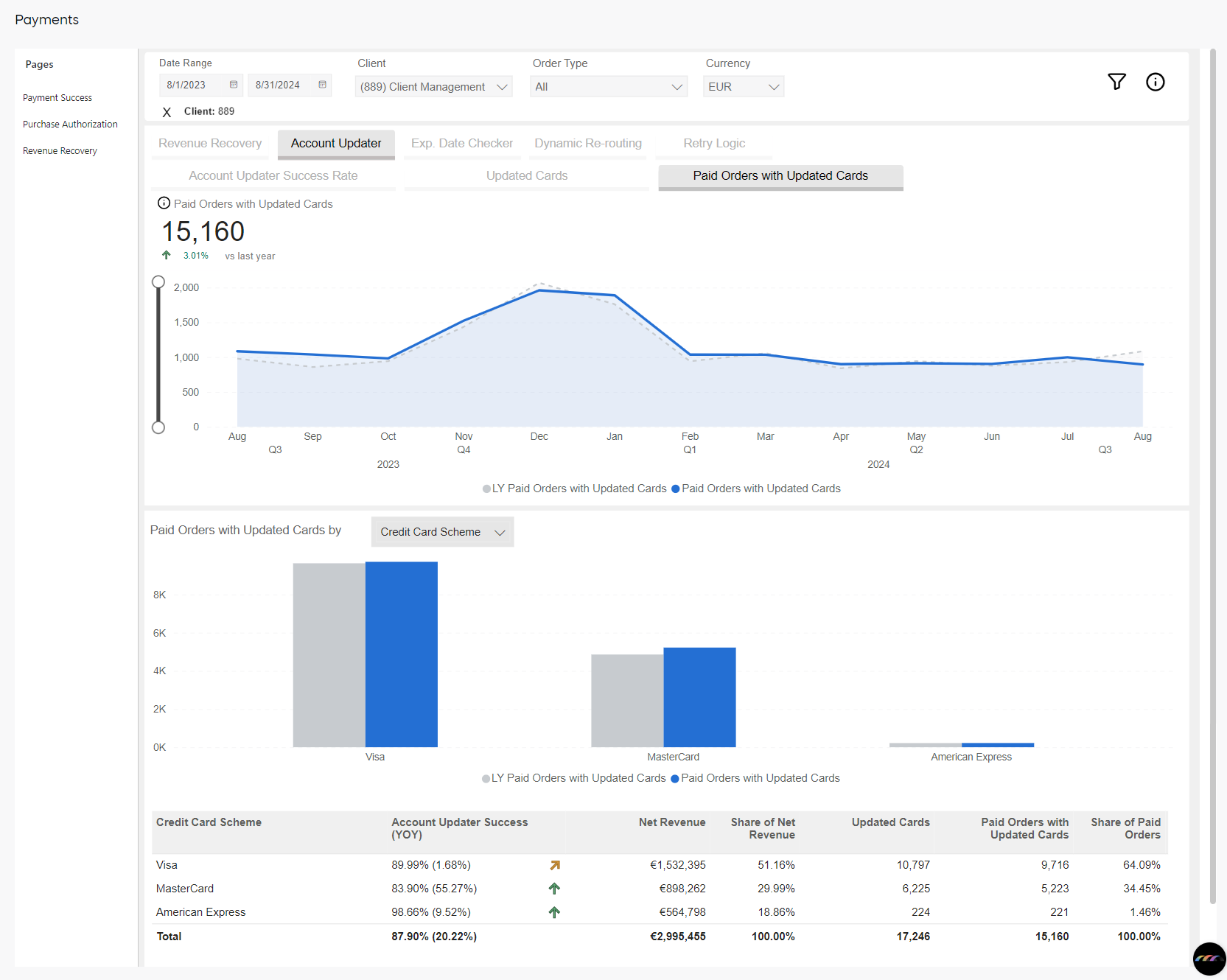

Account Updater graphs

The Account Updater graphs include data on the success rate of cards with successfully paid orders, the number of updated cards, and the number of paid orders associated with those updated cards during the selected period and the same period last year.

The Account Updater graphs are:

Account Updater Success Rate

Percentage of cards with successfully paid orders out of total updated cards during the selected period and the same period last year.

Updated Cards

Number of credit cards, during the selected period and the same period last year, for which renewal details were received from the credit card companies when the Account Updater identified that the cards were due for renewal.

Paid Orders with Updated Cards

Number of orders paid for with credit cards, during the selected period the and same period last year, for which renewal details were received from the credit card companies when the account updater identified that the cards were due for renewal.

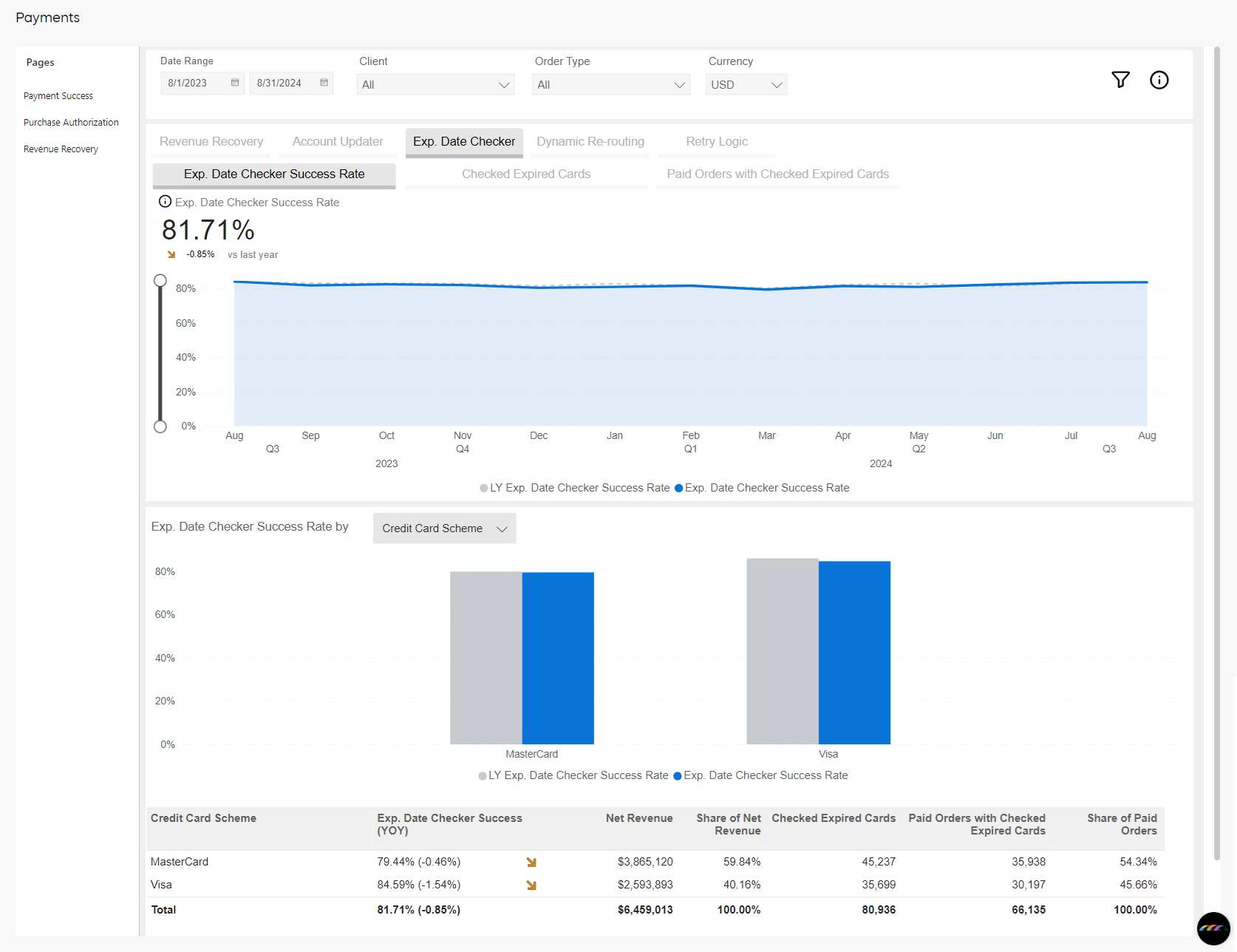

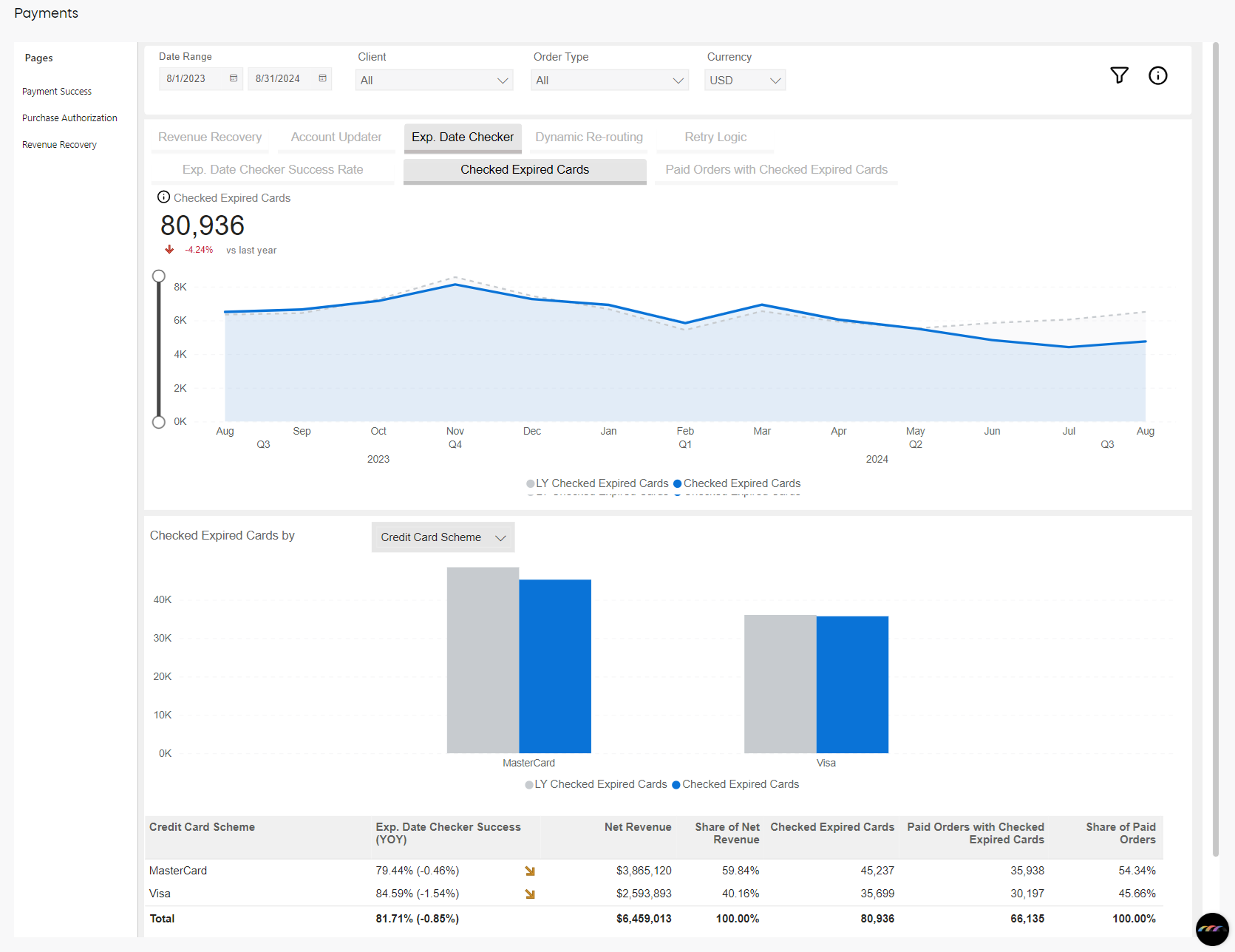

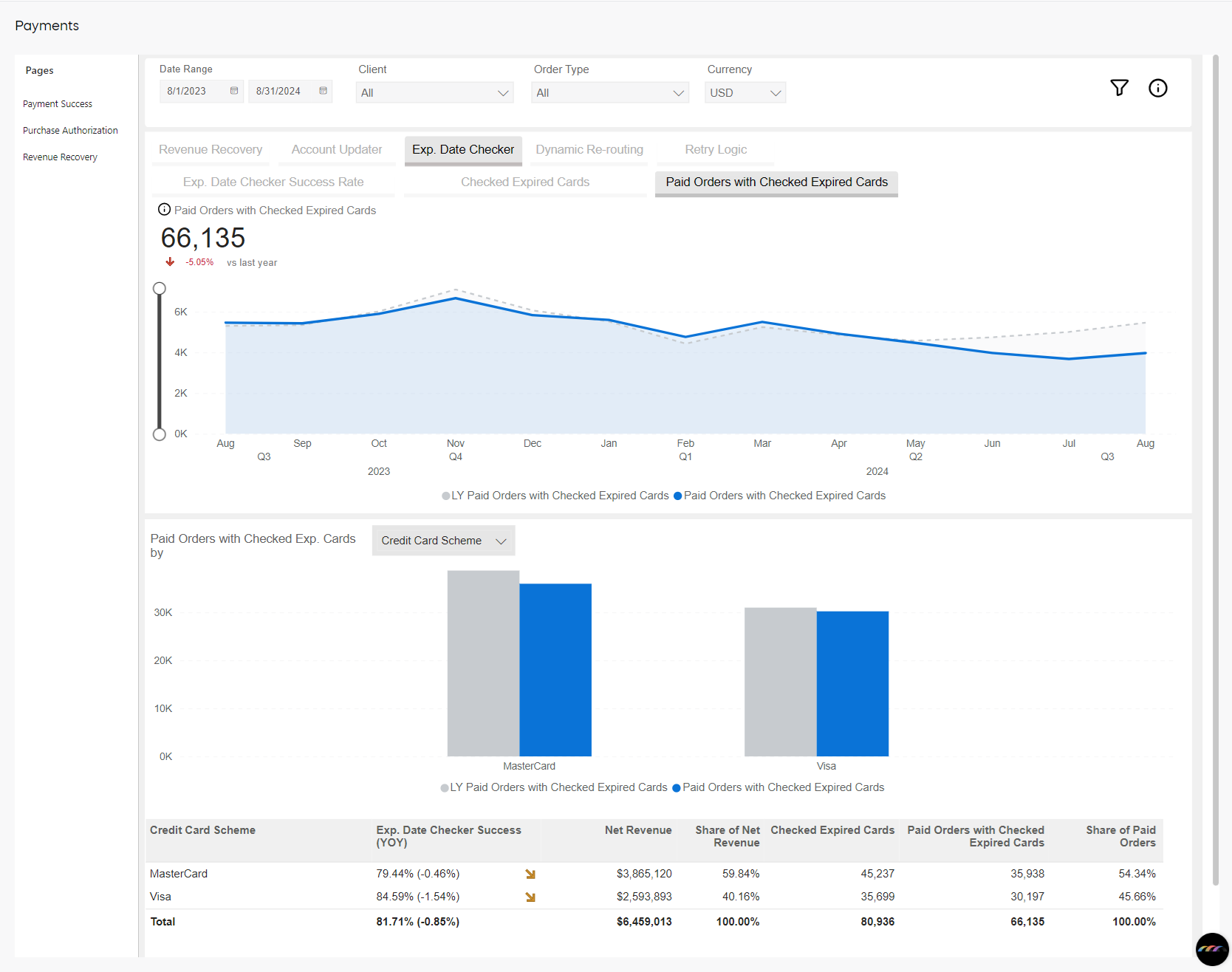

Exp. Date Checker graphs

The Exp. Date Checker graphs depict the success rate of the Expiration Date Checker in updating and converting expired cards into successful renewals, along with the number of checked expired cards and the corresponding paid orders that resulted in successful renewals during the selected period and the same period last year.

The Exp. Date Checker graphs are:

Exp. Date Checker Success Rate

Shows the percentage of successful Expiry Date Checker renewals for the selected year versus previous year.

Checked Expired Cards

Number of credit cards, during the selected period and the same period last year, that were checked using the Account Updater and identified as due for renewal.

Paid Orders with Checked Expired Cards

Number of orders, during the selected period and the same period last year, with successfully updated expiration date using the Expiry Date Checker, that were converted into a successful renewal.

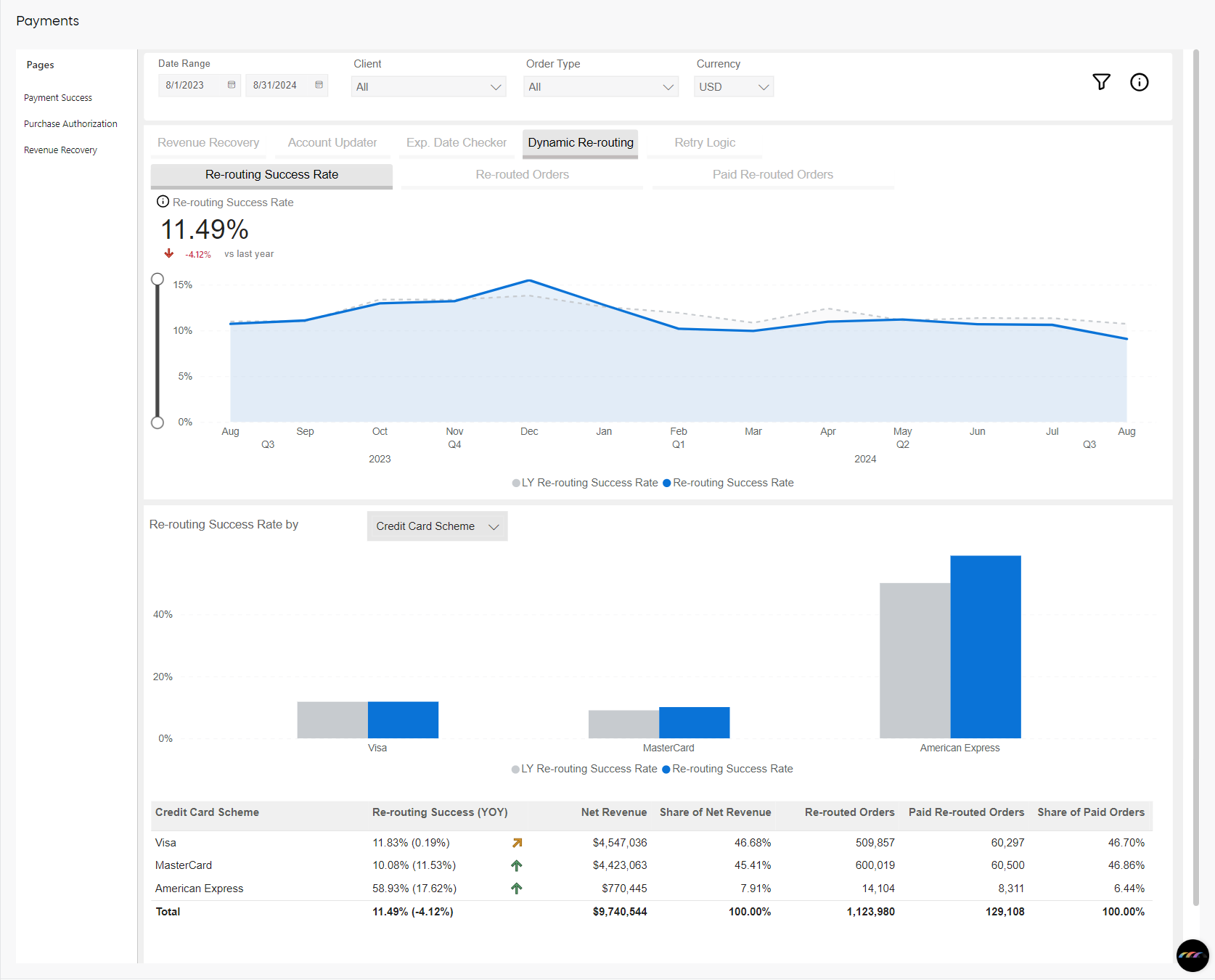

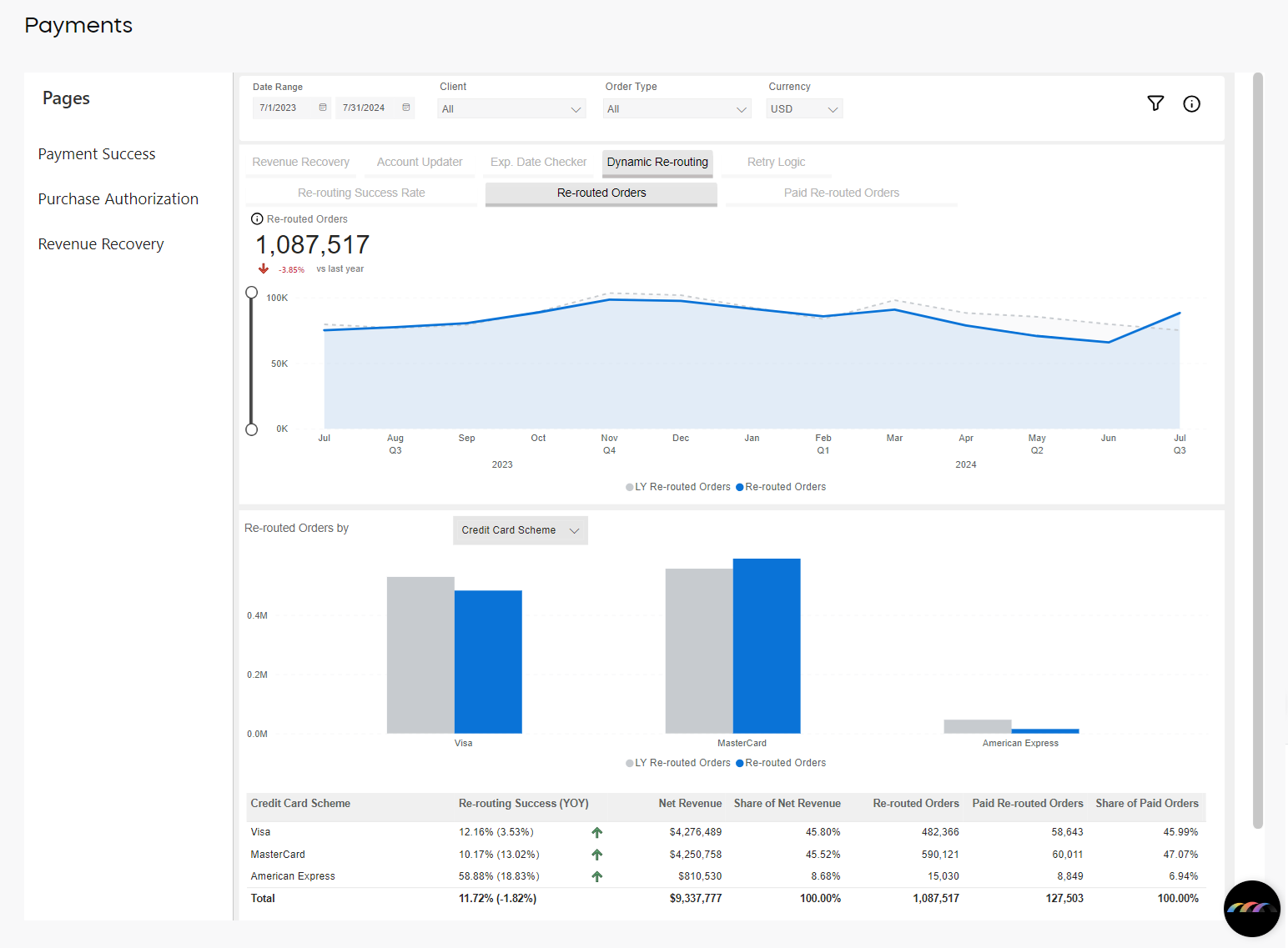

Dynamic Re-routing graphs

The Dynamic Re-routing graphs display the success rate of orders that were rerouted and delivered to secondary acquirers, as well as the number of rerouted orders and the corresponding number of paid orders that were successfully delivered to secondary acquirers, during the selected period and the same period last year.

The Dynamic Re-routing graphs are:

Re-routing Success Rate

Percentage of orders, during the selected period and the same period last year, that were rerouted and delivered to secondary acquirers and were paid for.

Re-routed Orders

Number of orders, during the selected period and the same period last year, that were rerouted and delivered to secondary acquirers due to the initial unsuccessful attempt to deliver them to primary acquirers.

Paid Re-routed Orders

Number of orders, during the selected period and the same period last year, that were rerouted and delivered to secondary acquirers and paid for.

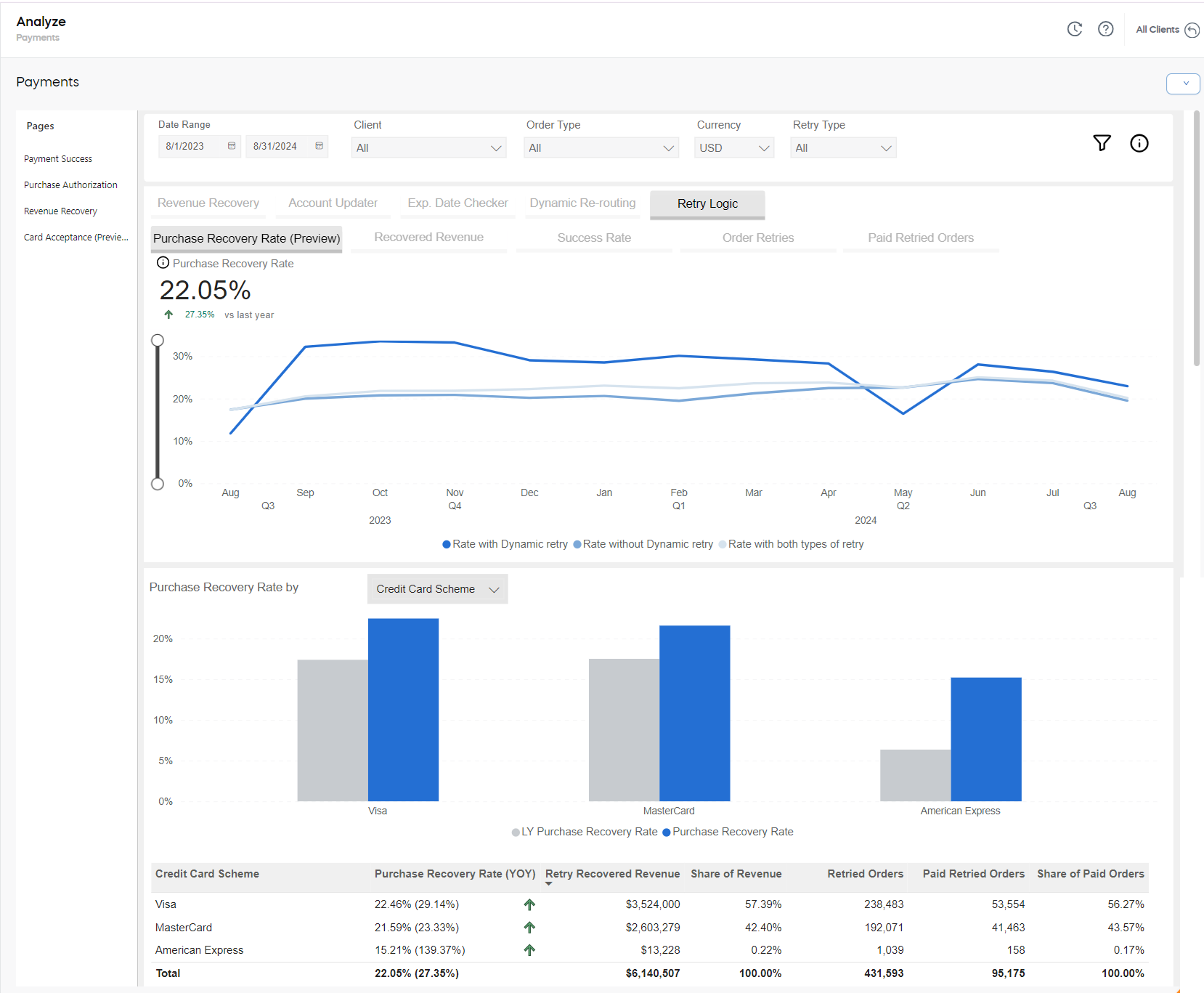

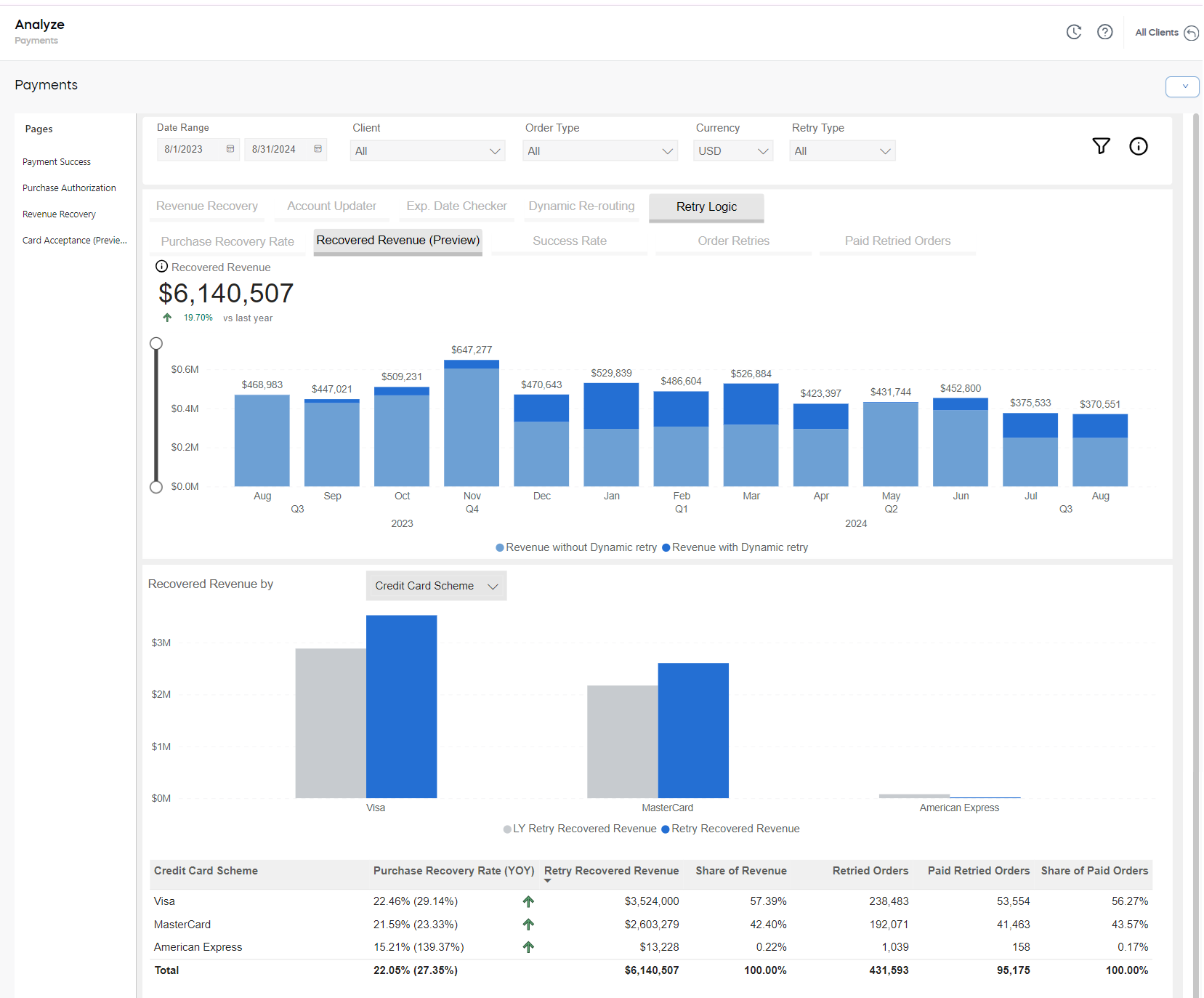

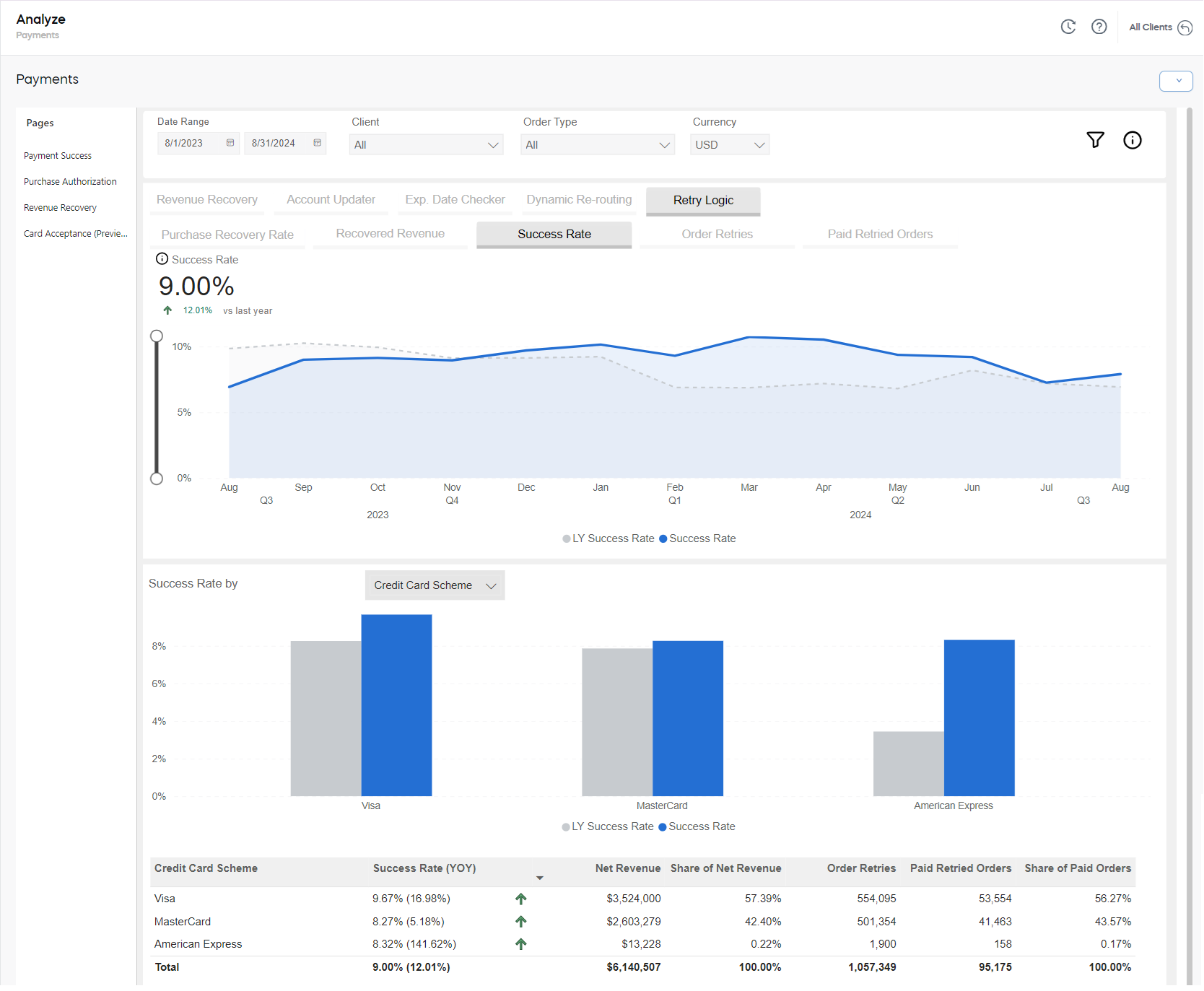

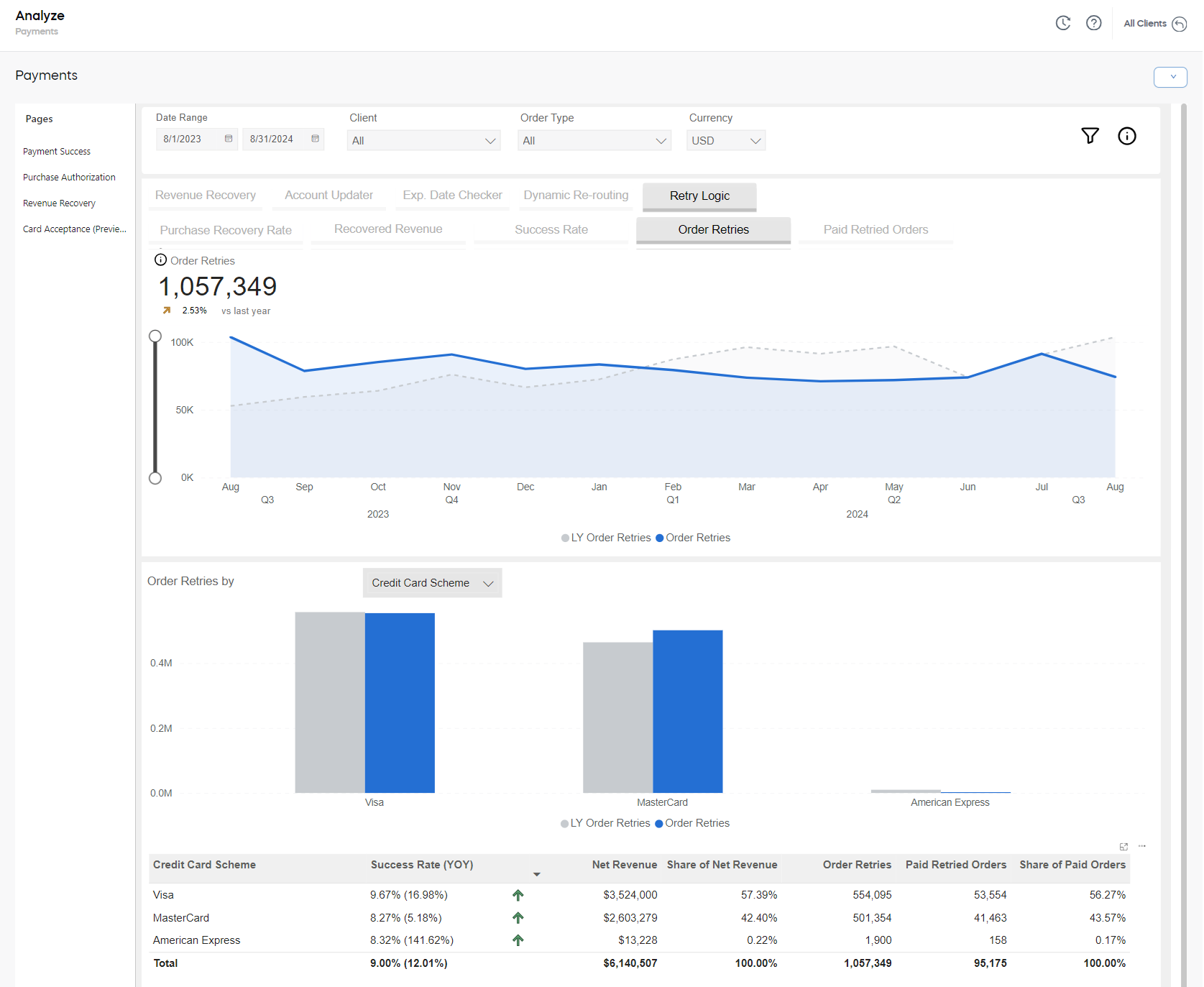

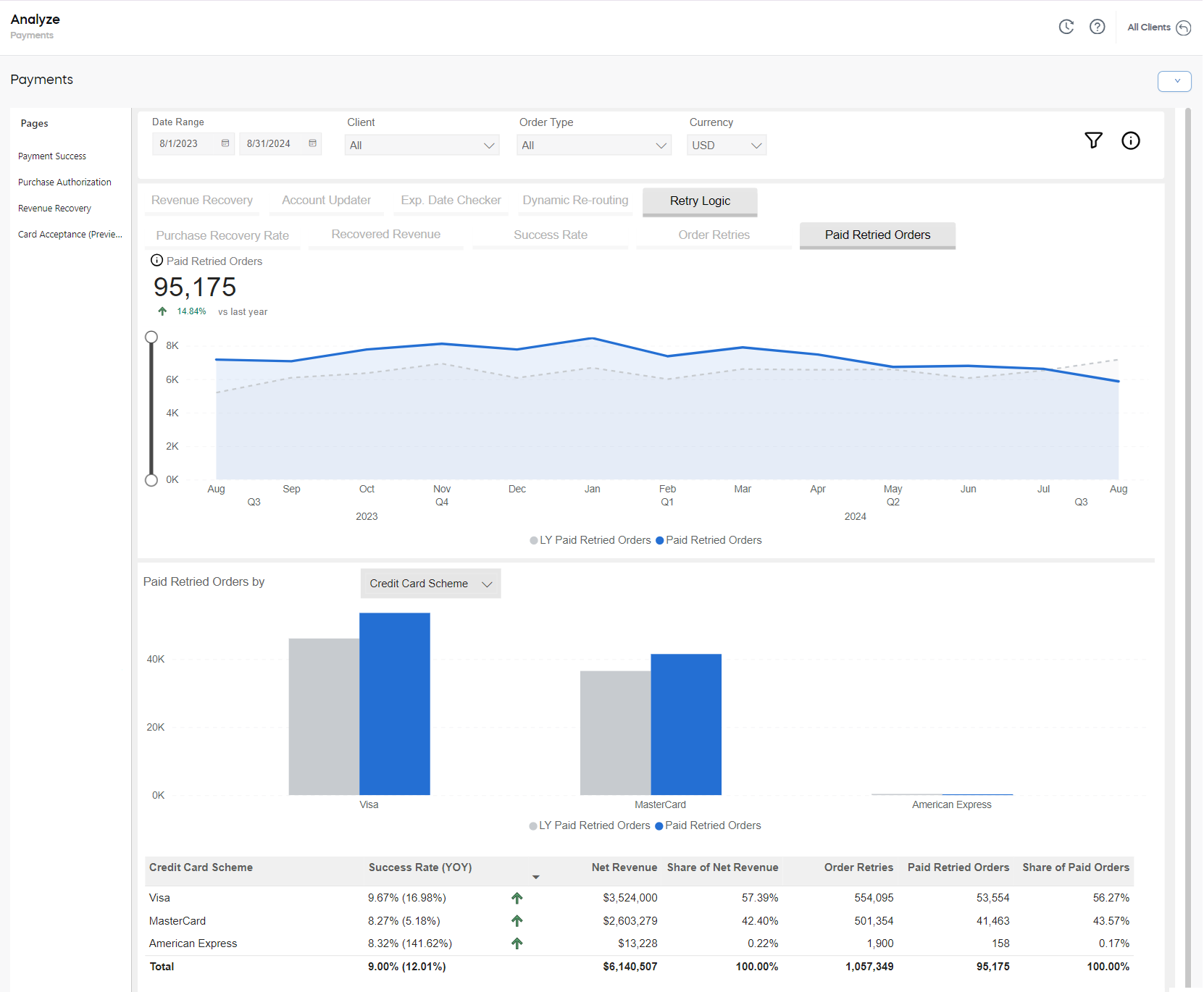

Retry Logic graphs

The Retry Logic graphs show key metrics related to order retries, such as the purchase recovery rate, revenue recovered from dynamic and static retries, the number of order retries and paid retried orders, and their ratio for both the selected period and the same period last year.

The Retry Logic graphs are:

Purchase Recovery Rate

The ratio of all paid retried orders to all retried orders. With this report you can see how well the specific retry mechanism works with a perspective of specific purchases.

Even if several order retries have been performed for one order, it is still treated as one retried order. The report can be generated for all retries, as well as dynamic retries, or static retries only (the Retry Type filter).

Recovered Revenue

The total amount of recovered renewal revenue that was recovered as a result of order retries. The report can be generated for all retries, as well as dynamic retries, or static retries only (the Retry Type filter). It provides insights into the effectiveness of different retry strategies and the financial impact they have on overall revenue recovery.

Retry Success Rate

The share of paid retried orders (order retries that resulted into renewals/paid orders) in the total number of orders retries.

Even one retried order can have several order retries, and all of them will be considered in the report.

This rate is calculated as follows: (paid order retries / order retries) * 100.

Order Retries

The number of order retries for the selected period and the same period last year. Please note, that even one Retried Order can have several Order Retries and all of them will be considered in the report.

Paid Retried Orders

The number of retried orders for the selected period and the same period last year which resulted in successful payments.

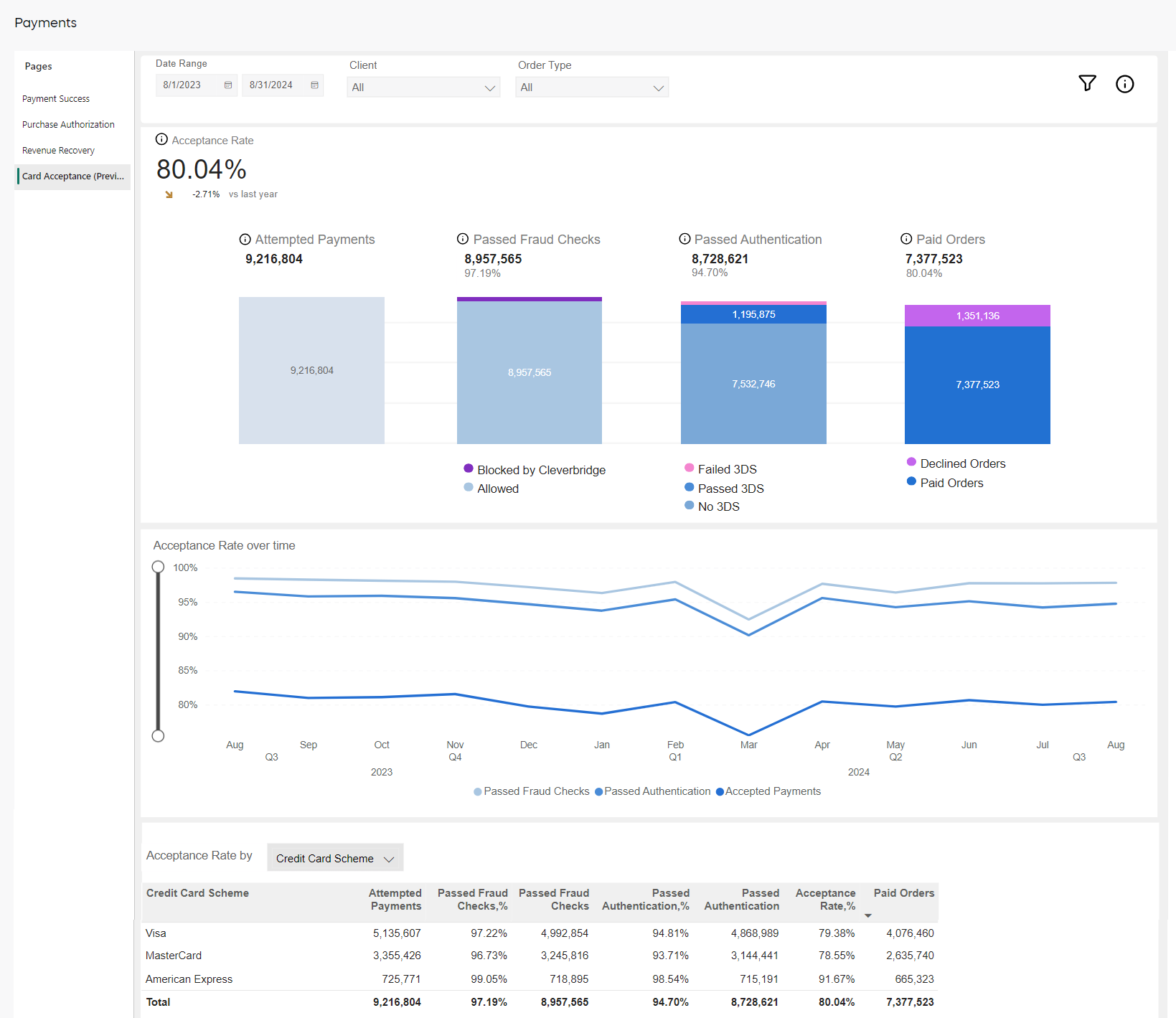

Card Acceptance page

The Card Acceptance page displays charts with information on Card Acceptance Rates over a period of time, providing detailed breakdowns of different payment stages, such as fraud checks and 3D Secure (3DS) authentication. The acceptance rate is a crucial metric for optimizing authorization strategies. A high acceptance rate indicates a smooth and efficient payment process, while a lower rate may highlight issues such as declined transactions, potential fraud concerns, or performance issues with payment providers. The Card Acceptance report is designed to provide clients, SCM, and payment support teams with comprehensive insights into card payment processing effectiveness.

The report contains bar charts presenting the total amount and percentage of attempted card payments, passed fraud checks, passed authentication, and accepted payments. The following charts are included:

- Attempted Payments: The chart displays the total count of card payment attempts recorded during a purchase process. The value includes purchase records with the statuses "New", "Authorized","Paid", "Payment Declined", and "Cancelled".

- Passed Fraud Checks: The breakdown of allowed card payment transactions that is such payment transactions that have successfully cleared fraud detection mechanisms and have been permitted to proceed against the attempted transactions. Not Passed Fraud Checks are those assigned any of the fraud-related payment statuses: "Order Declined in Manual Review", "Order Auto-Declined by System", "Order Blocked for Export Compliance", or "Declined in Manual Export Compliance Review".

- Passed Authentication: The breakdown of card payment transactions that have successfully completed the required 3D Secure authentication (Passed 3DS), the card payment transactions that bypassed or don't require the authentication (No 3DS) and those for which the authentication attempt has failed (Failed 3DS)

- Paid Orders: The breakdown of successfully processed orders (Paid Orders) compared to the count of orders assigned the "Declined" or "Cancelled" statuses (Declined Orders). The order is "Paid" when the payment has been received and information about product delivery has been dispatched. The Paid Orders metric includes one-time purchases, initial subscription payments, and recurring subscription payments. Successfully paid orders also account for those where a refund or chargeback was processed after the payment.

Below the charts, you can see a graph showcasing the Acceptance Rate metrics over time.

Manage the Dashboard

The dashboard lets you filter and explore your analytics with precision. You can apply filters like currency, product, or order type, and view detailed data by dimensions such as renewal period, payment method, or business category—all designed to give you targeted insights and flexible reporting.

Filters

When working with multi-item analytics, the drop-down elements on the right-hand side and the filters on top of the metrics allow you to filter the results. The applied filters are visible above the charts and can be cleared with the X sign.

You can filter the data by:

-

Currency: USD, EUR, or GBP

-

Date Range: Month-day-year

-

Order Type: Initial, One-time, or Renewal

-

Client: Cleverbridge client name/ID

-

Product List: a list of products you select and categorize for a particular purpose. One product can be contained in several product lists.

-

Product: Name/ID of the product

-

Renewal Type: Automatic, manual, or non-recurring

-

Renewal Period: Month, year, 2 years, or other

-

Payment Type, Subtype: Payment type and subtype used by a customer

-

Region, Country: World region as defined by Cleverbridge and billing country

-

APAC

- Australia

- China

- Hong Kong

- India

- Indonesia

- Japan

- Malaysia

- New Zealand

- Philippines

- Republic of Korea

- Singapore

- Taiwan

- Thailand

- Vietnam

-

EUROPE

- Albania

- Austria

- Belarus

- Belgium

- Bosnia and Herzegovina

- Bulgaria

- Canary Islands

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Macedonia

- Malta

- Monaco

- Montenegro

- Netherlands

- Norway

- Poland

- Portugal

- Republic of Moldova

- Romania

- San Marino

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Ukraine

- United Kingdom

-

LATAM

- Argentina

- Bolivia

- Brazil

- Chile

- Colombia

- Costa Rica

- Ecuador

- El Salvador

- Guatemala

- Honduras

- Mexico

- Nicaragua

- Panama

- Paraguay

- Peru

- Puerto Rico

- Uruguay

- Venezuela

-

NOAM

- Canada

- United States

-

ROW

- All other countries

-

-

B2B/B2C: Indicates whether the product was sold to a business (B2B) or a private customer (B2C)

-

Interval: Subscription interval number. See Subscription Interval Number in Subscription statuses and update options.

The Purchase Recovery Rate and Recovered Revenue graphs on the Revenue Recovery > Retry Logic page have an additional “Retry Type” filter with which you can define if the report is generated for all retries or only dynamic or static ones.

To view a required data range, use a slider on the left.

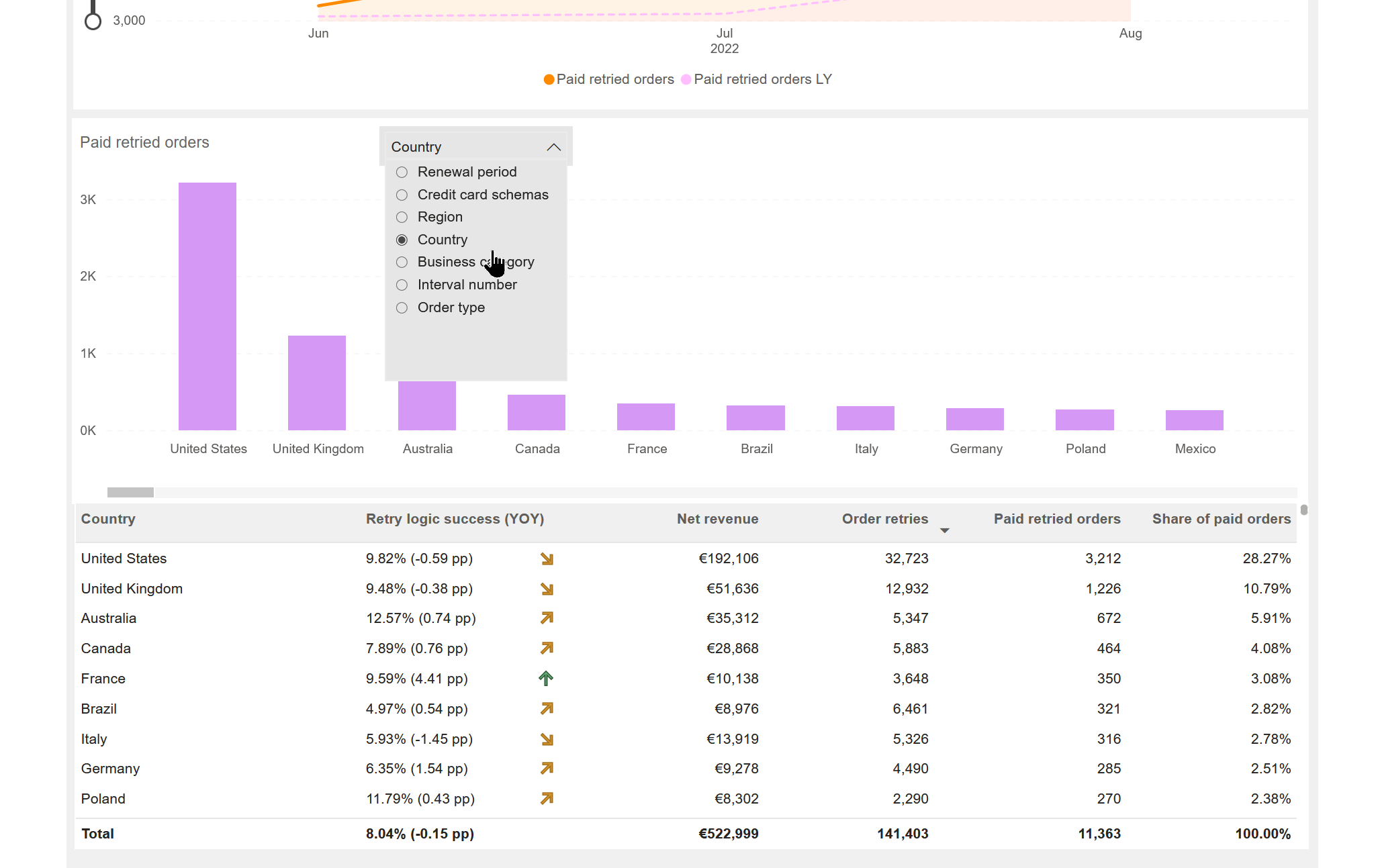

Report by dimension tables

Below each graph, there is a table with details report data that can be ordered based on the chosen dimension. Each dimension allows you to view and compare performance metrics from a different perspective.

The following dimensions are available:

- Renewal Period: Groups the data by subscription renewal cycles (for example, monthly, yearly), helping you analyze trends based on billing frequency.

- Credit Card Schemes / Payment Type: Breaks down performance by payment method, such as Visa, MasterCard, PayPal, or other available types, allowing you to assess payment success across different channels.

- Region: Aggregates results based on broader world regions (for example, APAC, LATAM, NOAM, Europe), offering insights into regional payment behavior and success rates.

- Country: Provides a more detailed breakdown by billing country, helping you identify specific geographic markets with stronger or weaker performance.

- Business Category: Filters the data by B2B (Business-to-Business) or B2C (Business-to-Consumer) transactions, helping you understand how different customer types affect payment outcomes.

- Interval Number: Groups subscription payments by their interval count (for example, first renewal, second renewal), enabling you to track churn or payment trends over the subscription lifecycle.

- Order Type: Segments data by the type of order (for example, Initial Purchase, One-Time Purchase, Renewal), letting you evaluate payment performance at different transaction stages.